A Final Look at 2023 Birmingham Housing Stats

If asked what their final thoughts are about the 2023 real estate market coming to an end most agents would probably reply “Good riddance”! The 2023 real estate market was not good to most in the industry and today we’re going to look at what happened in December with Birmingham Housing Stats as well as the year in general.

The housing market in Jefferson County, Alabama, for December 2023 exhibited several noteworthy trends:

1) Price Changes:

The median sold price in Jefferson County saw a slight decrease of -0.18%, going from $264,990 in December 2022 to $264,507 in December 2023. Similarly, the average sold price experienced a marginal decline of -0.46%, dropping from $339,059 to $337,503.

2) Price per Square Foot:

Positive trends were observed in the price per square foot metrics. The average price per square foot increased by 1.34%, rising from $149 to $151. The median price per square foot also saw a gain of 2.88%, going from $139 to $143.

3) Sales Activity:

The number of sales in Jefferson County decreased by -7.80%, dropping from 551 in December 2022 to 508 in December 2023. This decline suggests a decrease in market activity compared to the previous year.

4) Days on Market:

The average days on market increased by 20.69%, going from 29 days in December 2022 to 35 days in December 2023. However, the median days on market remained unchanged at 13 days, indicating some variation in the time properties spend on the market.

5) Sale Price Negotiation:

The average sale price to list price ratio (SP/LP) remained constant at 97%, indicating that, on average, properties are selling close to their listed prices without significant negotiation shifts.

6) Cash Sales:

The percentage of cash sales in Jefferson County increased notably by 19.23%, rising from 26% in December 2022 to 31% in December 2023. This suggests a potential shift towards more cash transactions within the market.

In summary, the Jefferson County housing market in December 2023 displayed a mix of trends. While there was a slight decline in median and average sold prices, positive shifts were observed in price-per-square-foot metrics. The decrease in the number of sales and the increase in average days on market suggest a less active market compared to the previous year. The stable sale price to list price ratio indicates a balanced negotiation environment. The notable rise in cash sales points towards potential changes in financing dynamics within the market.

Here are the trends for Shelby County, Alabama, for December 2023 based on MLS data:

1) Price Changes:

Shelby County experienced robust growth in median and average sold prices. The median sold price increased by 5.19%, rising from $347,000 in December 2022 to $365,000 in December 2023. Similarly, the average sold price saw a substantial growth of 10.84%, climbing from $387,825 to $429,867.

2) Price per Square Foot:

There was a positive trend in the price per square-foot metrics. The average price per square foot increased by 4.22%, from $166 to $173, while the median price per square foot rose by 5.56%, from $162 to $171.

3) Sales Activity:

Shelby County experienced a significant increase in the number of sales, up by 14.96% from 234 in December 2022 to 269 in December 2023. This uptick indicates heightened market activity and demand.

4)Days on Market:

The average days on market increased by 12%, going from 25 days in December 2022 to 28 days in December 2023. Similarly, the median days on market saw a 37.50% increase, rising from 8 to 11 days. Despite the increase, properties are still selling relatively quickly.

5) Sale Price Negotiation:

Sellers in Shelby County experienced a positive shift in negotiations. The average sale price to list price ratio (SP/LP) increased from 98% to 99%, indicating that, on average, properties are selling closer to their listed prices.

6) Cash Sales:

The percentage of cash sales in Shelby County increased significantly by 21.05%, going from 19% in December 2022 to 23% in December 2023. This suggests a potential shift towards more cash transactions in the market.

In summary, Shelby County’s housing market in December 2023 displayed strong positive indicators. Both median and average sold prices showed healthy growth, and the market experienced increased sales activity. Despite a slight increase in days on the market, the overall pace of sales remains relatively brisk. The rise in the sale price to list price ratio suggests a favorable environment for sellers and the notable increase in cash sales points towards changing financing dynamics within the market.

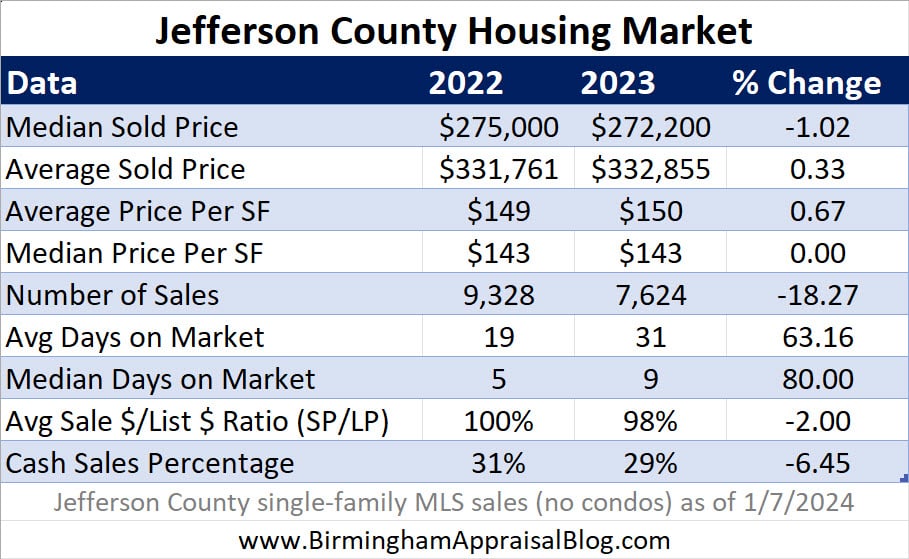

Birmingham Real Estate: 2023 vs 2022

With higher interest rates throughout 2023, there was a marked decrease in the number of houses sold. On an annual basis, Jefferson County saw an 18% decrease in houses sold while Shelby County decreased by 20%.

Along with sales volume, median prices were down in both Jefferson and Shelby Counties for 2023 compared to 2022. This is different than what we saw in 2022, where median prices were still increasing from the prior year due to steady demand and limited inventory.

The average prices did show a slight increase, however, the median is considered to be a better indicator of what is happening in the market. Homes in the higher price ranges can skew the average price more than the median price. The median price provides a better measure of the typical value of a home.

Properties took longer to sell in 2023. The average days on market increased by 63.16% in Jefferson County, going from 19 days in 2022 to 31 days in 2023. Similarly, the median days on market increased by 80%, rising from 5 to 9 days.

The average sale price to list price ratio (SP/LP) saw a decrease from 100% to 98%, indicating that sellers might be more open to negotiations on their listed prices. Please refer to the chart fo the Shelby County Stats.

One thing to keep in mind is the variances in key market indicators depend on location and time frame. While December saw monthly increases in some stats, when looked at on an annual basis we get a different story.

Seasonality plays an important part when looking at sales numbers and each month can vary depending on what part of the year is being analyzed. Because of this, it is good practice to compare monthly numbers on a year-over-year basis.

What About 2024?

So now that 2023 is in the rearview mirror what about 2024? First off I want to say that nobody can reliably predict the market so I won’t even try.

There’s an old saying that states that even a blind squirrel finds an acorn once in a while. The so-called “experts” may get lucky with a guess now and then but we shouldn’t let their predictions dictate how we’ll face the market. With that being said let’s take a look at what factors could drive the Birmingham real estate market in 2024.

Interest Rates: The decline in interest rates set off a chain reaction in 2020 that led to some of the steepest increases in home prices in recent times. When interest rates started to reverse and head back up sales declined.

We know that the market is very sensitive to rates so what happens in 2024 will be strongly influenced by what direction interest rates go. Some experts claim that rates will drop in 2024 and if this does happen then we can expect sales to increase.

Fence Sitters: If interest rates drop it’s a pretty good bet that those buyers that have been sitting on the fence waiting for rates to drop will make a move. They will contribute to an increase in the number of houses sold and increase competition between existing buyers. The increase in rates two years ago during the first quarter of 2022 knocked a lot of people out of the market, however with lower rates and more purchasing power mortgage payments will be more affordable.

More Sellers Entering the Market: With the increased competition among buyers, more homeowners will consider selling. Look at what happened in 2020 when rates declined; prices increased making it more attractive to sellers.

Supply: With an existing inventory that is still lower than typical, the supply of homes will still be an issue. If this is not fixed we may start to see more competition as we did in 2020 and 2021 where multiple offers and overbidding became commonplace.

I have started to see agents posting more about multiple offers already this year. How much this continues will all depend on the number and amount of rate drops that occur this year.

Pricing: We all know what happened when rates dropped before. Rate drops will of course increase the number of buyers as I noted above and with limited inventory prices will most likely rise.

Appraisal Values: What will happen with appraisal values in 2024? Like everything else it all depends on what happens with rates. A sustained level of increasing prices will most likely be reflected in appraisal values.

The appraisal by its nature measures historical values. If appraisal values are to increase it will need to be documented through the use of closed sales that show increasing prices as well as the analysis of active and pending sales that reflect the dynamics of supply and demand in the current market.

Question

Do you have any questions about the Birmingham real estate market? If so, do not hesitate to contact me, and as always thanks for reading.

This is really thorough, Tom. I love seeing the market with such great details too. Many of the stats echo what I’m seeing in my area in Sacramento too. Hope your year is starting well.

Thanks, Ryan. Interesting how different areas of the country mirror each other in various aspects. Yes, 2024 has started off well!