Technology’s role in rental property investment market

Housing Wire

APRIL 24, 2024

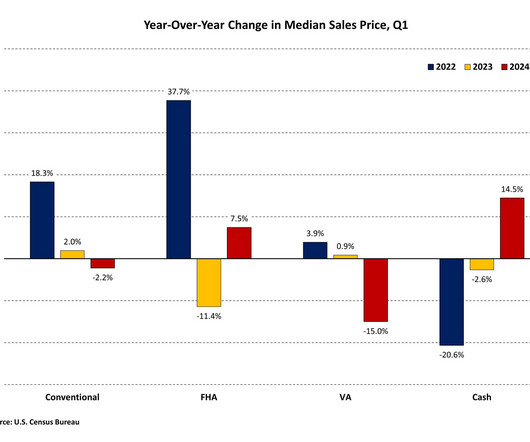

The rental segment has been marked by strong demand and looks to continue on this trajectory given mortgage rates that continue to hover around 7% and record property prices across many U.S. regions. In spite of some slowdown, rents have continued to appreciate, being nearly 30% higher than prior to the pandemic, with February levels up 3.5% as compared to the previous year.

Let's personalize your content