First, I hope you are enjoying the summer and our beautiful weather. I thought this month’s feature photo – looking west from Olympic Sculpture Park – was a perfect metaphor for the time of year. Sit, relax, enjoy the sun and take in the view. You deserve it!

======

There is no one-size-fits-all solution to solving our shortage of affordable homes but one answer that appears to have wider appeal is to aggressively advocate for accessory dwelling units (ADUs) – either attached to a structure or detached (DADU) in a backyard. I have written on this topic before.

Many local governments permit at least one dwelling unit with the main residence and some locales accept an attached and detached unit on the same property. Most zoning laws grant units up to 1000 sq. ft. and requirements for off-street parking for the second residence are being eased community by community.

What’s not to like about an affordable housing option with private access, bedroom, kitchen, bath and living area? Also known as a mother-in-law or cottage, the dwellings can offer viable housing to younger buyers seeking to save for their first home or enable seniors to age within a familiar neighborhood. For homeowners wishing to add a dwelling, the outcome can be steady rental income unless offered free to, say, a family member.

ADUs also help local economies by providing housing to people on the lower-to-middle economic scale to live within typically pricy urban areas that are closer to job centers and greater public transportation options. Experts believe the additional dwelling results in a smaller carbon footprint because of shorter inner-city commutes, while the homes open greater wealth-generating opportunities to those residents.

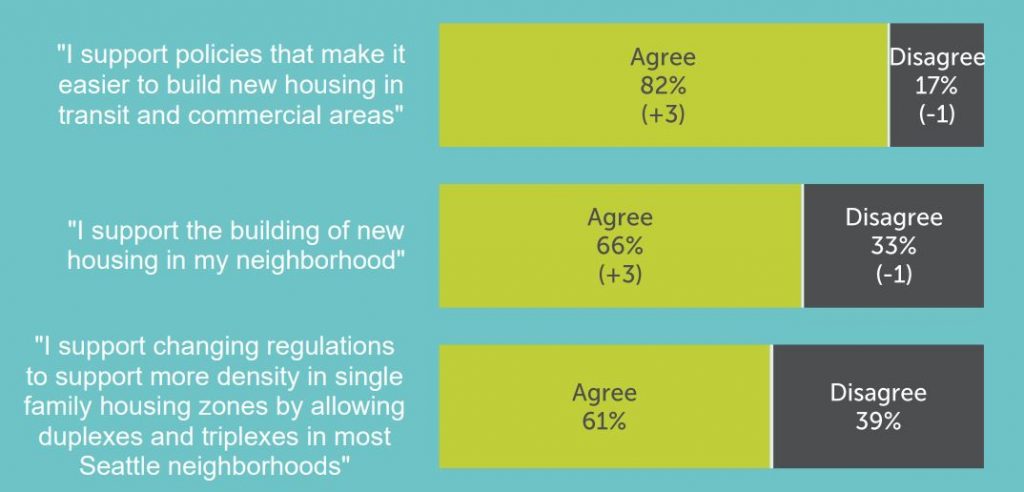

To take it one big step further, governments should grant property owners the right to sell detached ADUs to boost family incomes by reducing rent dependence and address missing-middle housing, a topic covered in this newsletter. Most of us tend to understand the need to improve our housing shortage, with one recent quality-of-life survey of 700 Seattle registered voters in favor of policy changes:

Local governments are finally acting. Kenmore allows ADUs of up to 1500 sq. ft. The cities of Seattle and Renton offer pre-approved ADU designs to help streamline the government-approval process which can often be onerous. (Don’t get me started about Seattle’s design review exercise!)

Kirkland gets it too. The Eastside community permits two ADUs per parcel (including one DADU) of no more than 1200 sq. ft. and no owner-occupancy requirements on the property. Just to the south in Bellevue however, DADUs are banned while ADUs may be no more than 800 sq. ft. and property owners must live on-site.

Housing affordability is one of the greatest challenges we face as a region. Demand for affordable homes is far outpacing supply, driving up today’s cost to rent or own. Solving this issue should be the highest need or we all suffer.

For our area to grow as one, the state must step in and encourage municipalities to see the distinct advantages of increasing affordable housing through accessory dwellings – among other initiatives – and not place barriers in the way of economic success.

RECESSIONS AND MORTGAGE RATES

Recent data and the traditional definition show we are now in a recession even though there is debate among economic and political folks. What is true is that every time we lean in and face the headwinds of economic weakness the housing market is a welcome refuge.

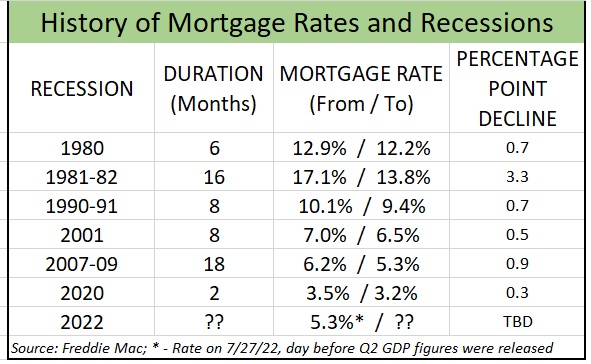

As this chart shows, each time the economy slowed significantly, mortgage rates declined. In fact, rates have fallen by an average of 1.1 percentage points over the 58 cumulative months of a recession between 1980 and 2020:

Average 30-year mortgage rates stood at 5.3% when, on July 28, the Commerce Department reported its second consecutive quarter of GDP declines – the common definition of a recession. Freddie Mac noted the average rate touched just below 5% in the first week of August, generating debate about whether we have seen a peak in rates.

Lawrence Yun, chief economist at the National Association of Realtors® (NAR), said in late July: “There are indications that mortgage rates may be topping or very close to a cyclical high.” Yun’s counterpart at realtor.com, George Ratiu, responded: “I still expect mortgage rates to move toward 6% … however a recession or fears of one can temper that.”

Whether we are technically in a recession doesn’t matter to consumers who may be on edge amid frustratingly high costs.

Does what we see in the chart mean there will be a decline of about one percentage point from today’s rates by the time our economic slowdown subsides? Let’s not jump to conclusions or make assumptions, but it’s interesting to note that when bad economic times hit our shores mortgage rates tend to be a silver lining.

CLIMATE CHANGE AND RISKS TO HOUSING

The weather this time of year often drives the “global warming warning” conversation. To be sure, climate change will have widespread impacts on society as well as our housing environment. Whether it’s flooding, wildfires or drought, people who live in high-risk areas will potentially suffer physical and/or financial harm to their property.

That’s the conclusion of a 2021 report from the Research Institute for Housing America, which signaled added “stress” on housing and housing finance industries in determining risk. Insurers are increasingly exposed to the climate crisis and are currently under-charging premiums by about 58% to at-risk property owners, the report states.

The Federal Emergency Management Agency estimates that 13M people in the U.S. – or 4% of the population – live in high-flood-risk areas, but FEMA maps used by the insurance industry are often out of date, including 11% of them last updated in the 1970s and ‘80s. An independent estimate from 2018 claims roughly 40% of the nation is in a flood-risk area.

You don’t have to be a scientist to realize the number of climate-related events has increased in frequency and intensity across the globe. Kentucky is an example of repeated disasters. A climate-risk assessment published by the Risky Business Project estimated that between $66B and $160B worth of real estate will be below sea level by 2050.

Beyond the devastation of flooding, there are the life-changing events related to rising temperatures – drought and wildfires. Homeowners, insurers and policymakers will need to find ways to cope with the totality of these disasters – another cost to living in this time of rising seas, rising temperatures and rising concerns.

BY THE NUMBERS

>> SmartAsset analyzed more than 300 of the largest U.S. cities to determine the fastest-rising housing markets and two in our area ranked in the Top 25. Everett claimed the No. 3 spot while Bellevue took No. 25. SmartAsset used three metrics – home value growth, income growth and housing demand – to reach its findings.

>> Returning to work will come with a price. Seattle ranks seventh in the nation for most expensive commutes. Autoinsurance.org found the average daily trip to work is 28 minutes in our areas at an annual cost of $9790. Fremont, Calif., has the most expensive commute ($15,005) and longest at 36 minutes on average, while Lubbock, Texas, has the least expensive trip ($2874) and only 16 minutes in duration.

>> The City of Seattle includes about 375,000 homes and estimates it needs to build 152,000 market-rate units by 2045 to catch up with the city’s growing population, according to the Office of Planning and Community Development. That’s 40% more homes than we have today.

>> Seattle’s population increased by 20,100 residents, or 2.7%, in the 12 months ending in April. That’s according to our state’s Office of Financial Management (OFM). The city is now at an all-time population high of 762,500. King County overall gained 1.3% in population over the past year, while Snohomish added 1.1% and Pierce gained 1.0%. Washington grew by 1.3% to 7.86M people, according to OFM, which forecasts a state population of more than 8M by this time next year.

>> Washington is the best state for Millennials to live in, according to research from WalletHub. The personal-finance site compared states on 34 metrics, such as Millennial employment data, voter turnout and total share of Millennials. The other Washington, as in D.C., was ranked second, followed by Massachusetts. Mississippi was last.

>> Of the 8.8M Hispanic households in the U.S., 48% own homes, reflecting a steady rise since 2014. Data from the National Association of Hispanic Real Estate Professionals also show Latinos buy homes at a younger age than most Americans, with 34% of Latino homeowners aged 18-24, as opposed to 17% of the general population.

>> A full 9.6% of all U.S. home sales in Q1 were fix-and-flips of single-family and condo homes, according to ATTOM Data Solutions. That’s up from 4.9% in Q1 of 2021 and is the highest rate of home flipping in the 21st century. The gross profit of a typical flip was $67K in Q1, down from $70K a year ago.

AUGUST HOUSING UPDATE

The market recalibration continues across King County with a sharp drop in new listings, Pending sales and closings while prices decline. Inventories are on the rise, so much so that one area is now considered a buyer’s market.

The number of new homes for sale fell 19% (4009) across the county from June to July and 9.5% year-on-year (YoY). New listings are down 24% (1335) in Seattle and 16% (1273) on the Eastside in the last month for all home types.

Homes going under contract were off 4.0% (2705) from June and 30% YoY in King, while the number of sales for July was 19% lower (2535) than a month ago and off 37% YoY across the county.

The percentages were almost identical for single-family homes, with King County new listings falling 19% (3153) month-to-month and 6.5% YoY. Seattle’s new single-family listings were off 25% (932) from June and down 19% (979) on the Eastside.

Pending single-family sales were down a mere 4.3% (2098) in the past month for King, but down a full 16% (612) in Seattle. They were surprisingly up 5.3% (575) on the Eastside. Closed sales were off 21% (1952) for the county, including down 19% (642) in Seattle and 29% (479) lower on the Eastside.

It’s common to see a drop-off in activity after the spring housing peak but these figures are slightly more pronounced. We can point to rising inflation as the primary reason for the market shift (It’s not a correction!), along with interest rates about two percentage points higher than at the start of 2022. But putting everything into context, the current real estate environment is arguably one of the best in at least three years for buyers if they can afford to make their move.

“The housing market is resetting in a buyer-friendly direction,” Danielle Hall, chief economist at realtor.com, was quoted as saying last week.

The bright spots include increasing inventory and falling prices across most of the region. The number of single-family-home listings on the market at the end of July was 13% (3684) higher in King when compared to the end of June. The number of homes available on Aug. 1 was 16% higher (981) month-to-month in Seattle and 8.3% (1197) on the Eastside, as well as more than double (107%) YoY across the county.

The median price of all homes sold in King for July was $810,000, down 4.8% from June but still 2.7% higher YoY. The price of a single-family home in the county fell 5.1% for the month to $890,000, which is down an incredible 11% (or $108,888) since May. The median price today is only 2.2% higher than this time last year.

Monthly median single-family prices lost a notable 5.5% ($622,500) in Southwest King (Federal Way, Des Moines), 5.3% ($1.42M) on the Eastside and 4.6% ($954,500) in Seattle. Eastside and Seattle prices are up about 6.5% YoY, a far cry from the double-digit price increases in 2020-21. Also catching my eye is what are believed to be the first examples of 12-month declines in median prices for our county since the start of the pandemic – down a sharp 4.9% YoY ($1,262,500) in an area comprised of Redmond and Carnation, down 4.3% ($717,500) for the year in the SODO/Beacon Hill area and off 4.1% ($769,500) in Mt. Baker/Rainier Valley.

Even as prices decline, final sales figures are averaging 0.4% above the asking price for all King County homes sold in July down from 3.5% above asking only a month ago. This suggests buyers were still paying top dollar for their dream home. What’s different than a few months ago is that many offers are being accepted with buyer conditions, such as a home-inspection contingency and seller credits at closing to either reduce the mortgage interest rate or address repairs after move-in.

Will prices continue to fall? Lawrence Yun, chief economist for NAR, told a U.S. Senate committee in late July, that nationally: “Any short-term price adjustments, if they occur, will be less consequential compared to the immense longer-term housing affordability challenges we face as a country.”

Inventory levels are mounting in King, now at 1.9 months, up from 1.3 in June and more than double from May for all home types (single-family, townhome and condo) and single-family homes as a stand-alone category. Single-family inventory stands at 2.5 months on the Eastside, up from 1.6 a month ago, and at 1.5 months in Seattle, up from 1.1 in June. Single-family inventory more than doubled to 2.8 months since June in Renton Highlands and ballooned to 3.9 months, virtually a balanced market, in the Bellevue area west of I-405 that includes pricey Medina.

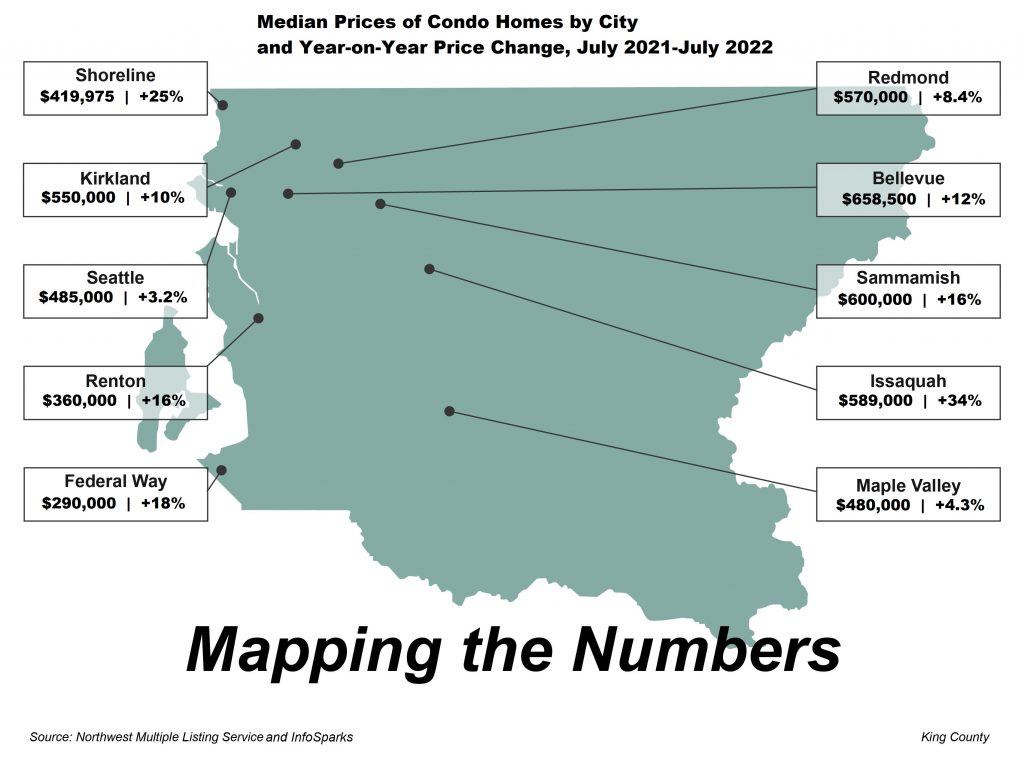

The county’s condo market is going through similar gyrations. New listings are down 18% (856) in the past month, including down 21% (403) in Seattle, while Active listings as of Aug. 1 were up 8.7% (1034) in King, including 13% (296) higher on the Eastside. Pending condo sales are off 3.2% (607) in King despite climbing 7.1% (197) for the month on the Eastside. Closed sales declined 12% (583) in the county month to month, including down 17% (177) on the Eastside and 13% (244) in Seattle.

Condo prices fell 6.7% ($490,000) for the month but remain 6.5% higher YoY. Prices were flat in Seattle ($537,000) and down 7.6% ($575,000) on the Eastside for the month. Inventory stands at 1.8 months for King, up from 1.4 last month. There are 2.5 months’ inventory in the Seattle condo market, meaning it would take that length of time to exhaust all existing listings if no other homes came up for sale. The Belltown/downtown Seattle condo market has seen a jump to 5.8 months’ inventory, by definition, now a buyer’s market.

In addition to King County’s 4.8% median price month-to-month decline on all home types, to $810,000, Kitsap County experienced the sharpest drop – 11% ($535,000) from June to July. Snohomish median prices fell 1.7% ($737,500) for the month and Pierce dropped 1.0% (565,000).

Single-family-home prices in King fell 5.1% ($890,000) since June, surpassed only by Kitsap’s 10% ($409,500) decline. Snohomish saw single-family median prices fall 3.7% ($770,000) in the past month, while Pierce prices bucked the trend by rising 1.1% ($575,000). Year-to-year, single-family prices remain higher, led by Pierce up 13%, followed by Snohomish (10%), Kitsap (5.5%) and King (2.2%). Median condo prices remain higher for the year, up a strong 22% ($384,750) in Kitsap, 16% ($412,500) in Pierce, 6.5% ($490,000) in King and 5.7% in Snohomish ($500,000).

Looking for a “bargain” on a home? Ferry County, in northeastern Washington, experienced a 22% YoY drop in median prices for all homes, falling below $200K ($194,500), though that is based on only 10 sales in July.

Note: All data is sourced from the Northwest Multiple Listing Service, which excludes sales of new construction homes.

Click here for the full monthly report.

CONDO NEWS

Seattle received a double dose of bad news on the condo front – and on the same day.

Bosa Development announced on July 22 that it was pausing work on the Civic Square project across the street from City Hall because of rising building costs and uncertainties in the broader construction market.

The British Columbia developer revealed in March plans for a 57-story, 422-unit, mixed-use condo in a full city block between 3rd and 4th avenues and Cherry and James streets. It’s now on hold.

At the same time, the developer of a twin high-rise on the western edge of Denny Triangle announced it would begin construction soon but build the project as an apartment community instead of the planned condominium. The location of the 45-story towers on 6th Avenue between Battery and Bell streets was controversial from the start, as the structures will remove prime views for neighboring condo owners on the east side of Insignia Towers across the street.

After about 2 years of delays, Seattle House is moving forward but as rentals.

The news should come as no great surprise. It reflects market conditions – weakened buyer appetite amid unsettled back-to-office rules, increasing financial burdens caused by rising inflation and enough available inventory to satisfy existing condo buyers.

=====

Looking for a sweet deal on a new-construction condo? The Emerald may be just the gem!

The 40-story, luxury high-rise a block away from Pike Place Market is one of a handful of newer condo towers offering promotions. The Emerald has a deal on a select number of residences: 10% off the list price on homes that close by Aug. 31. That’s a potential savings of up to $130K on the highest-priced home! More details are available here and I am more than happy to show you the building.

The sales teams at Spire (until Aug. 31), KODA (until Aug. 20) and Gridiron (through summer) have promotions as well. Contact me to discuss options.

LUXURY LIVING

You’ve heard the phrase “Go big or go home.” Well, “Go big AND go home” may apply for this pricy property on Hunts Point. It’s a 4-bedroom, 5-bath, 5850 sq. ft., 2-story home with basement on nearly an acre. The soaring ceilings in this 1967-built home catch your eye upon entering, followed by walls of glass that allow you to see peaceful East-facing waterfront views toward the rear of the property. The next owner will envy the manicured grounds and ~100 feet of shoreline with private dock. A great place to call home. The list price is steep (that’s the “Go big” part!): $21.5M ($3675/sq. ft.). It’s worth noting that last year’s highest-priced sale of a single-family home in our area was on the same Hunts Point street – $32M.

Described as the “last of the large parcels” in the Redmond area, the long-time owners of 35-plus acres are looking for a buyer in Union Hill. The sale includes a 5-bed, 4.25-bath, 4450 sq. ft., 1-story home with finished basement, a charming bunkhouse cabin and equestrian amenities. A horse farm hidden within the tallest of trees now searching for a new owner. The area is large enough to subdivide into seven properties or keep the sweeping cascade views, rolling pastures and serene sounds of songbirds all to yourself. List price on the mid-century Northwest home: $6.95M ($1561/sq. ft.) An adjacent 22 acres is also available for sale.

Looking for a deal on a luxury home? I might have just the spot for you! Check out this 5-bed, 5.5-bath, 11,412 sq. ft., 2-story with basement on 10 acres in the May Valley section of unincorporated Issaquah. The Ralph Anderson-designed estate sits on a plateau near Squak Mountain and provides outstanding Cascade views. The iconic Northwest contemporary home delivers wood ceilings, beams, custom built-ins and floors. A massive wine cellar, sports courts and putting green will keep everyone busy. Surprisingly, this home has been on the market for a little more than a year. Today’s list price: $8.298M ($727/sq. ft.) is a 44% discount from the original figure of $14.75M.

Have you ever thought of operating your own bed and breakfast? Well, there is a stately Capitol Hill mansion looking for a buyer of the Shafer Baillie Mansion, a well-established B&B about two blocks south of Volunteer Park. The 1914-built, 2 ½-story structure includes 13 bedrooms and 12 bathrooms within 10,950 finished sq. ft. of history. Artisan hand-carved dark wood window and door frames, pillars and moldings harken to the days of afternoon tea or listening to music on the phonograph by a roaring fire. Bedrooms, baths and a large kitchen have been updated to modern standards while complimented by vestiges of the past, including radiator heat, leaded windows and pedestal sinks. The top-floor grand ballroom was converted into bedrooms and feature arched ceilings and period light fixtures. It’s a mansion fit for royalty. List: $4.998M ($365/sq. ft.).

Saving the best for last perhaps, here is a jaw-dropping penthouse suite atop one of the stateliest buildings in the city – The One Eleven, adjacent to Kerry Park. Just look at this – a 3-bed, 4-bath, 5356 sq. ft. masterpiece on the entire 9th floor. The original space was taken down to the shell and reimaged to create an epic palace with breathtaking 300-degree views of Seattle, including the famed city skyline and Mt. Rainier. The anonymous owners (one of which, I have learned, is an established author and life coach) spared no expense, using high-end appliances for the chef’s kitchen, custom black walnut cabinets and doors, and heated concrete floors. A private deck offers plenty of room for outdoor dining or watching the ever-changing light dance across the city and sound. List: $12M ($2240/sq. ft.).

What else is happening in and around your Seattle?

Discovery Park – 50th Anniversary

Seattle’s largest and oldest park celebrates its 50th anniversary with a range of events throughout the year. Once the home to Salish Sea peoples and then a military fort, Discovery Park on Magnolia Bluff is now home to vast greenspace, picnic meadows and playground areas, a beachfront and culture center. Check the calendar for events to mark the golden anniversary or just visit the park when the moment feels right.

Tattoo Exposition, Aug. 19-21

Admire art on skin at the Seattle Tattoo Expo, featuring competitions, seminars and vendors. Get your next tattoo! Check it out at Seattle Center Exhibition Hall, 301 Mercer Street. Tickets.

Eastside Fun, Aug. 20

The cities of Redmond and Sammamish will be holding big events on the same day. Chomp! pays tribute to local farmers and packages it up into a fun day of eating, drinking and playing at Marymoor Park. 10am-6pm. Down the road, Sammamish Party on the Plateau has music, a beer & wine garden, food and games at Sammamish Commons Plaza, 801 228th Avenue Southeast. Free. 12-8pm. (A similar, family friendly event is taking place on the same day in Shoreline. 12-9pm.)

Seward Park Run, Aug. 27

The Summer 5K, 10K and 15K runs are set for you and your friends in beautiful Seward Park, 5900 Lake Washington Boulevard South. There’s even a 1K run for kids! Register now. 8:30am.

Ice Cream Fest, Aug. 27-28

If you’re like me and love ice cream, then this event is for you! Scooped is an all-you-can-eat ice cream paradise. Music, food, kids’ activities and, yes, mounds of ice cream can be found near the Seattle Center International Fountain. Tickets. 12-10pm, Saturday, and 12-6pm, Sunday.

The Fair, Sept. 2-25

It’s time once again for the Washington State Fair! Animals, rides, food and entertainment – everything you would expect and more – are on display at the Washington State Fair Events Center in Puyallup. Plus, there are 20 nights of top-notch live entertainment, including Blake Shelton (Sept. 3), The Beach Boys (Sept. 5) and Lynyrd Skynyrd (Sept. 25). Get in on the fun! (Closed Tuesdays and Sept. 7)

Italian Street Fair, Sept. 9-11

Enjoy Italian food, music and a beer & wine garden at the San Gennaro Festival of Seattle. Bring the kids for special activities and see cooking demonstrations near Beneficial Brewing, 1225 South Angelo Street, in the Georgetown neighborhood of Seattle.

Seattle Seahawks home opener, Sept. 12

A new-look Seahawks team kicks off the 2022 campaign at home with a Monday Night Football tilt that is already the talk of the town. Russell Wilson brings his new Denver Broncos team to Lumen Field for a Hollywood-scripted battle in his former backyard. The 18-game regular season concludes in early January with a home battle against the defending Super Bowl champion Los Angeles Rams. Tickets.

Oktoberfest, Sept. 16-18

Two neighboring communities offer competing Oktoberfest festivities on this busy weekend. The Great Wallingford Wurst Fest is a kid-friendly event, Sept. 16-17 at St. Benedict School, 4811 Wallingford Avenue North, while Fremont Oktoberfest runs an extra day, Sept. 16-18, at 3503 Phinney Avenue, for adults only (and dogs on Sunday). Both events feature food, beer and activities.

Events are subject to change. Please check with venues to confirm times and health-safety recommendations.

In case you missed it….

Here’s a rundown of activities on my Living the Dream blog, which publishes new stories every Tuesday:

The Seattle waterfront is undergoing quite a facelift with updates to the aquarium, roads and pedestrian connections from Pike Place Market. The upgrades are attracting notice from condo buyers seeking to be closer to the action. I showcase the condos nearest the waterfront and provide pricing insights.

At some point in homeownership, the roof will likely need repairs or replacement. I published my research on the many roofing options and costs.

It’s not uncommon for buyers to want their new home to include an electric-vehicle charging station. This story covers the types of chargers on the market and what you may expect to pay.

And finally, we have noted this housing market has been flipped on its head in only a few months. I examine Seattle/King County conditions for the second half of the year.

Thanks for reading and enjoy the rest of your summer!

Will