Whether you’re reading this within a few short days of its early 2024 publication or years later, the truth still holds: Buying a home in Seattle/King County is challenging. Affordability has been a hallmark topic in this region of the country (and many other parts of the U.S.) for several years.

It’s also true, however, that owning a home comes with benefits that cannot compare to renting. To be sure, some people will never own a home – and that’s okay. The reasons are many: financial constraints, family dynamics, or a desire to remain less anchored to a home than living as a renter.

Many others want to own and are scraping the funds together to reach their goal, while others are waiting for assurances that this is the long-term place to live before deciding to invest in a large purchase – arguably the biggest in someone’s lifetime.

Oh, and others are sitting on the fence about whether to take that big step toward homeownership. This is the group that should consider these important points about owning versus renting a home.

If you read the headlines and speak to financial advisors, many will espouse the belief that renting is better than owning in many parts of Western Washington. We indeed have a higher cost of living compared with just about everywhere else in the country. Gas and food prices have historically been more expensive here.

Are you sitting down? Research conducted by realtor.com in mid-2023 showed that Seattle had a nearly $2K difference between the median monthly rent ($2168) and median monthly home-purchase costs ($4156). Preliminary data for Seattle shows rental prices in September for all newly leased units were down 4.6% year-on-year – a rare YoY decline for any goods and services.

Headlines aside, many prospective buyers have explained to me that they want to leap to homeownership but are waiting for prices and/or mortgage rates to come down. Yes, that’s the affordability challenge – meeting buyers in their happy spot as they manage budget responsibilities every month.

There is a concern, at least from this former business journalist, about those fence-sitters:

Prices rarely ever drop yearly; however, we just witnessed a time in which YoY declines hit all home types (single-family, townhome and condo) combined in King County during eight of the previous 12 months. They plummeted by as much as 10% YoY in April 2023 but finished the calendar year in positive territory.

Last April was the first double-digit YoY decline of home prices in King since a wild stretch, July 2011-February 2012, when every month experienced successive drops of 10% or more, including a whopping 18% YoY in October 2011 in the thick of the housing crisis and Great Recession.

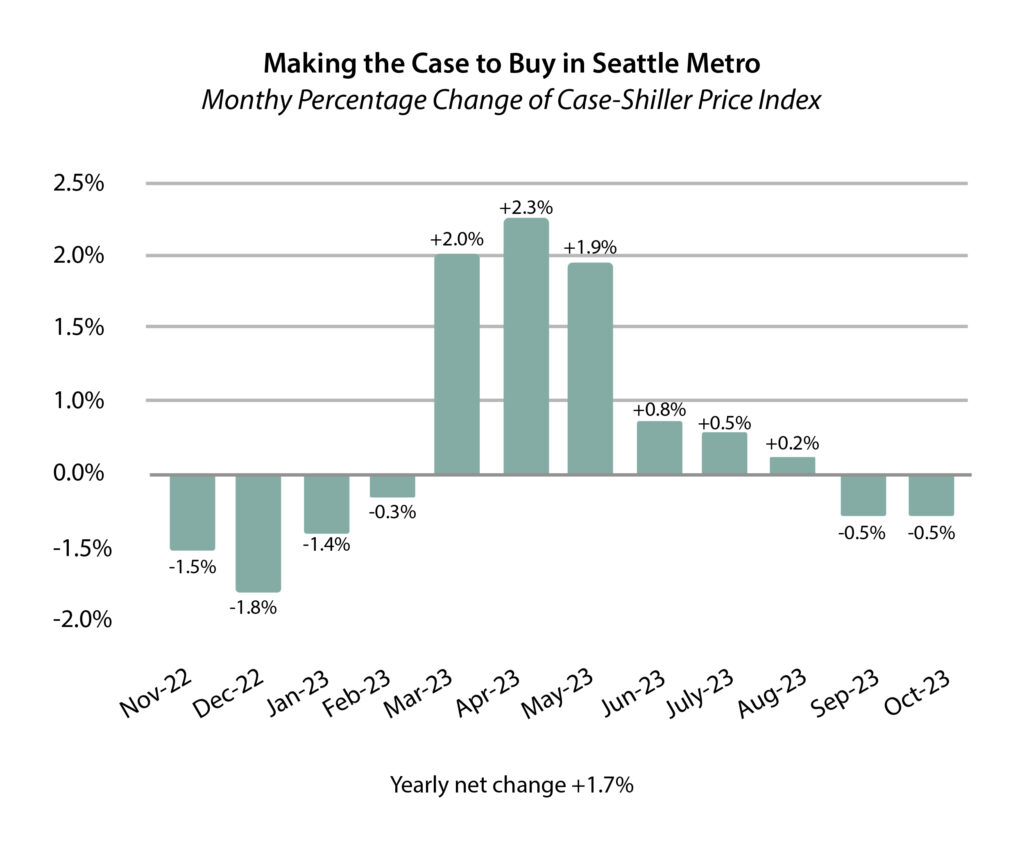

According to the Case-Shiller Home Price Index, the Seattle metro area saw prices rise 1.7% for the most recent 12 months reported. (Case-Shiller releases its reports about two months after the reporting period.) This modest price increase is the lowest YoY gain in recent memory and signals a bottoming out of the traditional 10-year housing cycle in this part of the country.

In other words, the housing rebound is approaching and should be in full swing by 2025 or 2026. That’s when we expect prices to resume their super-charged increases amid limited supply and a pent-up supply of buyers.

To use the above chart as an example of price appreciation, the value of a home has risen 1.7% on average across our region since November 2022. If you bought a starter home for $500,000 that month, the property would now be worth approximately $508,500 (1.7% x $500K). And that’s an example of price growth in a mild downturn. Just wait until the market accelerates again.

Taking this example to another level, let’s say you put 10% down on the home at purchase. A buyer could regain that $50K within 6 years through appreciation alone. That’s a conservative example in a housing market where prices have risen by 106% between December 2013 and December 2023, or 10.6% for each of those 10 years when spread equally.

Waiting for prices to decline will only lead to lost opportunity. The home listed at $500K a year ago may be on the market for $508,500 or so today (and likely climbing) and the opportunity to build equity on the purchase is lost at least for a year. At the same time, a landlord may have increased the rent by 3%-5%.

Look at any long-term (40+ years) chart of home prices. Not every year, of course, however real estate prices tend to rise – and rise again. If you hold onto a property for 5–10 years, the probability that it will lose value is very low.

A study of U.S. home sales for 2023 showed Seattle sellers earned a return on their home of 93% compared to their purchase price – essentially, almost double. That’s the third-highest return on investment of any major metro in the country. (Spokane was fourth-best in the nation with an ROI of 91%.) In other words, home values have soared in our state’s largest metros.

Yes, those rent vs. buy instant analysis websites or apps can offer a good reference point to get started. They tend to compare monthly mortgage payment amounts to monthly rents. This is useful but overly simplified.

Buyers/homeowners get appreciation (as noted above), amortization (the principal payment they make monthly lifts their equity value), and tax benefits (mortgage interest tax deductibility, large capital gains tax exclusions). Once on the property ladder, your financial position changes as the home builds value.

The burdens of renting – including the unpredictable expense from year to year and threats of eviction – can shorten life expectancy. People who apply more than 30% of their monthly income on rent may be less likely to spend on healthy foods and medical care, health experts say, potentially leading to premature death, found a study in the journal Social Science & Medicine.

A final thought: Buying a property – especially first-timers – doesn’t mean purchasing a so-called forever home. Buyers should approach this as stepping stones toward greater financial security and historical wealth-building. Sure, buyers often tell me that they don’t plan to move because they have found the perfect one – until they call about 5-10 years later, seeking to change their address for a variety of reasons. Hey, life happens!