To reach a key financial goal in 2026, Blend Labs plans to diversify far beyond mortgage. And it is putting its new cloud-based Blend Builder platform front and center.

On Tuesday, executives from the San Francisco, California-headquartered mortgage tech firm, which has yet to post a profit since going public in July 2021, shared the firm’s vision for growth during its first investor day.

Blend Builder – an initiative that started about four years ago and launched in March 2023 – is a cloud banking platform designed to help businesses in the financial services industry streamline processes for mortgages, loans, deposits and accounts.

“We will migrate all products to Blend Builder and anchor the customer’s originations ecosystem on one innovative platform,” Sebastian Joll, Blend’s head of revenue, told investors.

The goal for Blend Builder is to create a unified platform that can serve all the products that a bank can offer – including personal loans, credit cars, car loans, student loans and mortgages.

“[Our goal is ] Having a unified platform that can serve all the products that a bank can offer. Allow our customers to be there for every moment in the consumers’ financial lives that they want — whether it’s their first credit card when they’re getting their first job and their first checking account to later on their car loan and later on helping them with student loans or whatever it may be all the way through when they’re retiring,” Nima Ghamsari, CEO and co-founder of Blend, said.

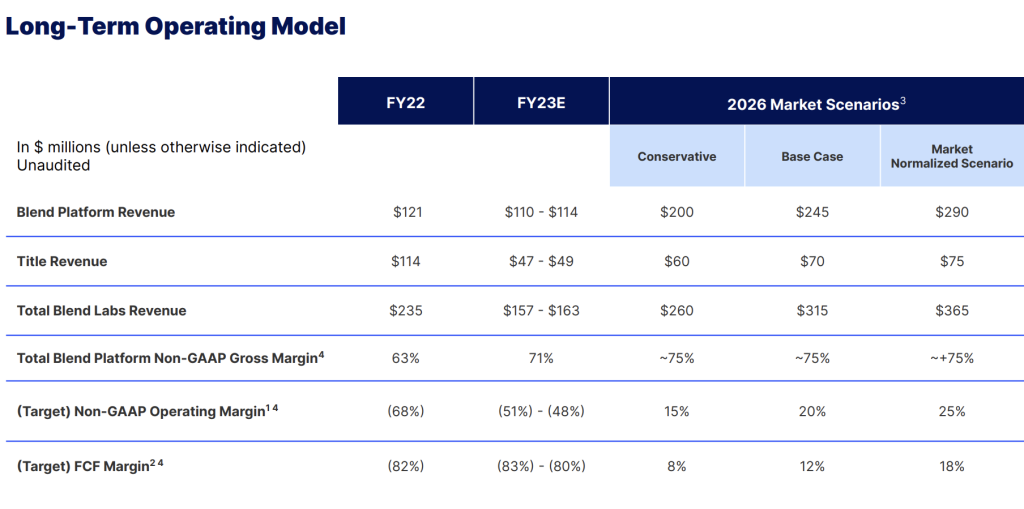

Achieving positive free cash flow by 2026 would represent a financial landmark for Blend.

”We are guiding to a free cash flow margin of 8% for our conservative case, 18% for the market norm, with our base case at 12%. It’s the first time that we’re now sharing free cash flow targets. It’s a testament to the success that we see in our future and with our customers,” Amir Jafari, Blend’s head of finance & administration, told investors.

In Q2 2023, Blend reported a non-GAAP net loss of $22.7 million in the second quarter, narrowing its financial loss compared to a non-GAAP net loss of $35.6 million in Q1 and non-GAAP net loss of $45.1 million in Q2 2022.

By focusing on cutting costs and prioritizing the Blend Builder platform, executives believe the firm can reach its non-GAAP profitability goal by 2024.

In April, Blend received notice from the New York Stock Exchange (NYSE) that it was not in compliance with the stock exchange’s bylaws, which state that a company could be delisted if its common stock traded below $1 for more than 30 trading days.

Blend regained compliance with the NYSE’s listing requirements as of July 31, 2023.

Ghamsari had emphasized growing its customer base and investing in tech to help lenders save on origination costs.

Blend has a mortgage market share of up to 20% as of early Q3 2023, up from 12% in Q3 2021 when it went public, according to the company on Tuesday. The mortgage firm also cut non-GAAP operating expenses to less than $38 million, from $62 million in Q3 2021.

Its new product and services include an AI-powered chat tool ‘Copilot’ that is aimed at executing precise tasks and deconstructing nuanced questions borrowers have.

Adding assets-derived income capability to its existing “Blend Income” product – launched Tuesday – will allow lenders to have additional ways to verify more income sources far earlier in the application process, the company said.

For Q3 2023, Jafari expected Blend’s non-GAAP net operating loss to come in between $16.5 million and $15.5 million, down from its prior guidance of a non-GAAP net operating loss of about $17.5 million and $15.5 million.

Blend platform revenue is projected to be around $28.5 million and $30 million; title revenue at around $11.5 million and $12 million totaling around $40 million and $42 million in revenue.

Over the next 12 months to 24 months, Blend plans to continue expansion within its customer base, move into deposits, credit cards, personal loans and adding home equity loans to improve the Blend Builder experience for its clients.

In the long term, the lender shared its vision to increase partnerships with other tech vendors in the originations ecosystem and work with other industry partners like Amazon Web Services.

Over the next three years, Blend aims to continue to grow market share and economic value per funded loans.

The mortgage tech firm also wants to increase its non-mortgage transaction to up to 30% in 2026 from the year-end goal of 15% to diversify its platform revenue mix.

“As for consolidation, it will be both a tailwind and a headwind for us. And it may impact the short term. But what we believe is, our technology will win in the long term, as it has already proven to do so,” Jafari said.