The holidays are just around the corner and the spirit of giving is in the air. And if you’re thinking of buying a home, a special gift in the form of cash from a relative to help with the purchase may be the ultimate holiday offering.

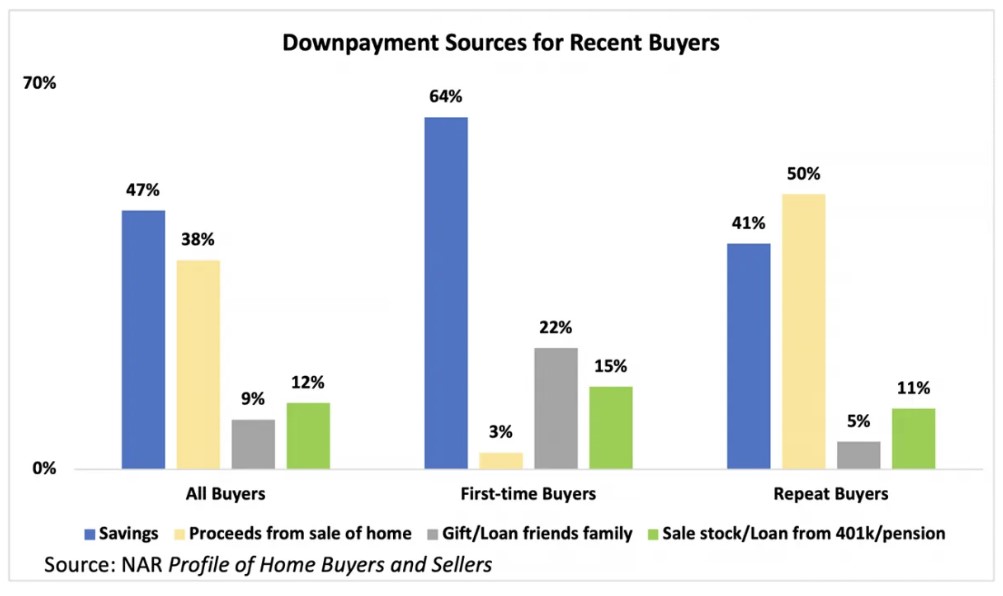

It’s perfectly legal, as long as buyers properly document the transfer of funds from the relative(s) and follow guidelines from their lender. The use of gift funds is popular – and almost a necessity – in this market, with about one in every five first-time buyers using money from a family member for at least part of the down payment.

This is not to be confused with down payment assistance from state and federal programs – another popular source of financial aid. At a time of high inflation, fluctuating mortgage interest rates and climbing home valuations, buyers would be wise to seek help from all corners to get on the property ladder or climb a rung.

When it comes to other people’s money, there are rules to accepting financial gifts meant for a down payment. Gift money is typically allowed for conventional, Federal Housing Administration, Veterans Administration and U.S. Department of Agriculture loans.

Any family member can provide funds to a relative for a down payment. That includes parents, grandparents, aunts, uncles, siblings, children, fiancés or domestic partners. As long as they can prove they are related by marriage, adoption or another form of legal guardianship, gift money is allowed. (The lifetime tax exemption in 2022 on gift funds – to individuals, political parties and charities – is $12.06 million, a figure that is expected to fall to $6M in 2026.)

Unlike the more-strict conventional mortgage, FHA, VA and USDA loans may accept cash gifts from a close friend, employer, charitable organization, labor union or potentially others unrelated to the buyer. In all cases, the down payment gift cannot come from anyone involved in the home purchase, such as the real estate agent, home builder or seller. (Sellers may offer a credit at closing instead.)

There is no dollar limit gifted to buyers but any one person may offer up to $16,000 before facing possible tax consequences from the IRS. (Washington does not tax gift money.) That is not to say a father, mother and both in-laws, for example, could offer $16K each tax-free. That’s allowed. Some buyers accept more than the limit and offer to pay the tax back to the giftor. (If that’s the case, buyers should speak with a financial adviser to understand what they are agreeing to and whether it makes financial sense.) [Editor’s Note: The gift-money ceiling was increased to $17,000 for tax year 2023.]

Rules may vary by loan type, an applicant’s financial standing and loan-underwriting guidelines. In addition, lenders may accept the entire down payment from a donor but in many cases, buyers are expected to pitch in a portion to qualify for the loan.

Many conventional loans require a 5% minimum investment from the buyer when including gift money, particularly when the offer price exceeds the local conforming loan limit ($891,250 in 2022 and rising next year). The gift money must have a paper trail, including:

- The gift must be documented with a formal letter (sample; PDF)

- Some underwriters ask for a copy of the donor’s bank statement (usually only the first page, with name, address and account balance). Requiring a statement can be a bone of contention for some family members who don’t wish to show their finances to a relative or lender. To avoid scrutiny, family members can send the gift funds 60 or more days before the lender begins the buyer’s application process and no questions will be asked. (Funds that are “seasoned” for 60+ days in the buyer’s account are as good as cash.)

- If the donor is gifting funds that were recently part of a stock portfolio, the transfer of money from equities to cash may require proof. (This process of verification can sometimes take weeks to complete.) The money should be delivered either by wire transfer, cashier’s check or personal check and written out to the same person who is purchasing the home or, to save a step, the funds can be directed to the escrow account linked to the home sale. (Be sure the escrow firm provides specific details to the person sending the gift to ensure the funds are directed to the correct buyer.)

- If the buyer receives the gift funds, they should be placed in the same bank account that will be used to submit the down payment on the home. Down payments should originate from one account in the same name as the buyer and delivered via wire or cashier’s check to escrow. (Always be careful of wire fraud!)

- The donor cannot require repayment of the money or it would be considered a loan and not a gift.

So, as you can see the idea of supplementing the down payment with a gift from the “bank of mom and dad” (and others) is permitted, but the rules are strict and vary in each applicant’s circumstance.

Speak with your lender to understand what’s possible with your purchase scenario. Happy home shopping!