In the March rate update, we discussed why Federal Housing Administration (FHA)-sponsored Home Equity Conversion Mortgages (HECMs) utilize two interest rates. The “expected rate” is unique to reverse mortgages and is calculated by adding the lender’s margin to the weekly average 10-year constant maturity treasury (CMT). This rate is used, among other things, to help determine a borrower’s initial principal limit (borrowing capacity).

For such a critical number, little has been written about the expected rate and its impact on HECM loans. In this month’s update, we’ll discuss two features you may not know about expected rates.

HUD publishes tables using expected rates in 1/8% increments

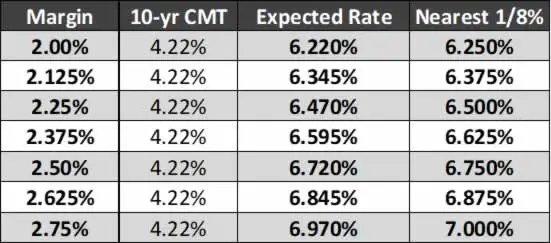

Because U.S. Department of Housing and Urban Development (HUD) look-up tables are published using expected rates in 1/8% increments (6.625%, 6.75%, 6.875%, etc.), we must use the nearest 1/8th percent (0.125%).

For example, a 2.50% lender margin combined with last week’s 10-year CMT average (4.22%) would produce an expected rate of 6.72% today. When looking up the borrower’s principal limit factor, we would use 6.75%. Here are sample lender margins and expected rates for the period from Apr. 2 to Apr. 8, 2024.

Because we use the nearest 1/8%, HECM proposals often don’t change from week to week unless the 10-year CMT moves enough to push expected rates beyond a rounding threshold.

Higher or lower expected rates impact principal limits

Higher expected rates reduce borrowing capacity, while lower expected rates increase borrowing capacity. So, it is understandable that HECM prospects want to know how unlocked expected rates could impact their principal limit.

We cannot determine the precise percentage until we know both the relevant age and the expected rate. Depending on those two factors, the impact could be 0.4% to 0.9% of a prospect’s home value. Nevertheless, the average impact of a 1/8% change in the expected rate is a little over 0.6%.

For example, a prospect with a $500,000 home could see their principal limit drop by an average of $3,000 (0.6%) from a 1/8% increase in expected rate. Conversely, their principal limit could increase by an average of $3,000 from a 1/8% decrease in the expected rate until that rate is locked.

April 2024 update

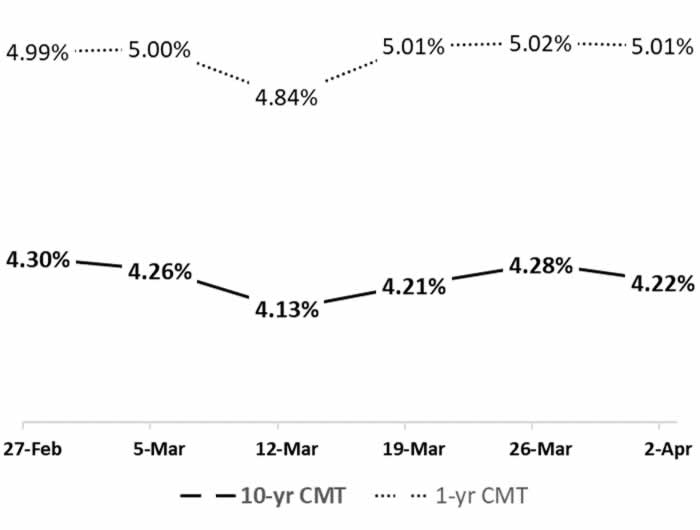

The 10-year CMT average dipped to 4.13% for one week in March, offering higher principal limits for new applications and some loans in processing. While the index rate in effect for April 2-8 is 9 basis points higher (4.22%), the 10-year CMT has been relatively flat since early February.

Example

With a 2.5% margin and resulting HECM expected rate of 6.72% (Effective 4/2/24 – 4/8/24), a 73-year-old homeowner with a $500,000 home appraisal for would qualify for 39.2% of the appraised value of the home. This equates to a principal limit of $196,000 as shown here:

- Expected rate: 6.72%

- Youngest age: 73

- Home value: $500,000

- Principal limit: $196,000

For updated principal limit calculations like this, a loan originator can use RapidReverse® (available on any Apple or Android mobile device) or use any HECM loan origination system of their choice.

Note: 2.5% lender margins are used for education purposes only. HUD expected rate look-up tables use the nearest 1/8% for calculating HECM principal limits.

This column does not necessarily reflect the opinion of Reverse Mortgage Daily and its owners.

To contact the author of this story: Dan Hultquist at [email protected]

To contact the editor responsible for this story: Chris Clow at [email protected]