Housing Market Down But Not Out- January Newsletter

Winter is here! Last week we had one evening of beautiful snow that quickly melted away. As I type, we are receiving winter weather watch notifications as we are getting ready for a more dangerous icing event here in North Texas this week. As we prepare for the coming cold, I am reminded that, although dramatic, most of the weather events here never last long. So we will get everything done tomorrow morning before it hits and I’m planning to make some homemade chili!

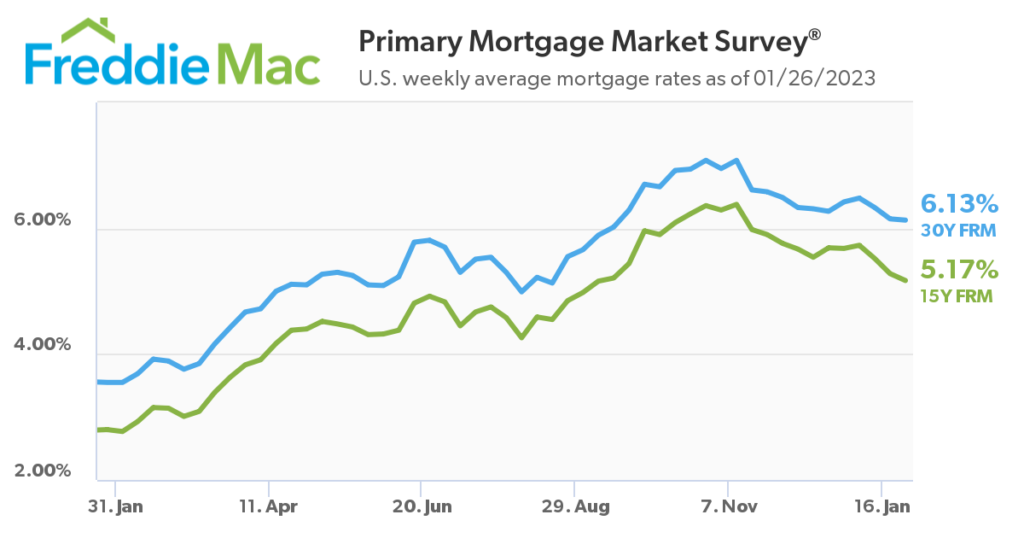

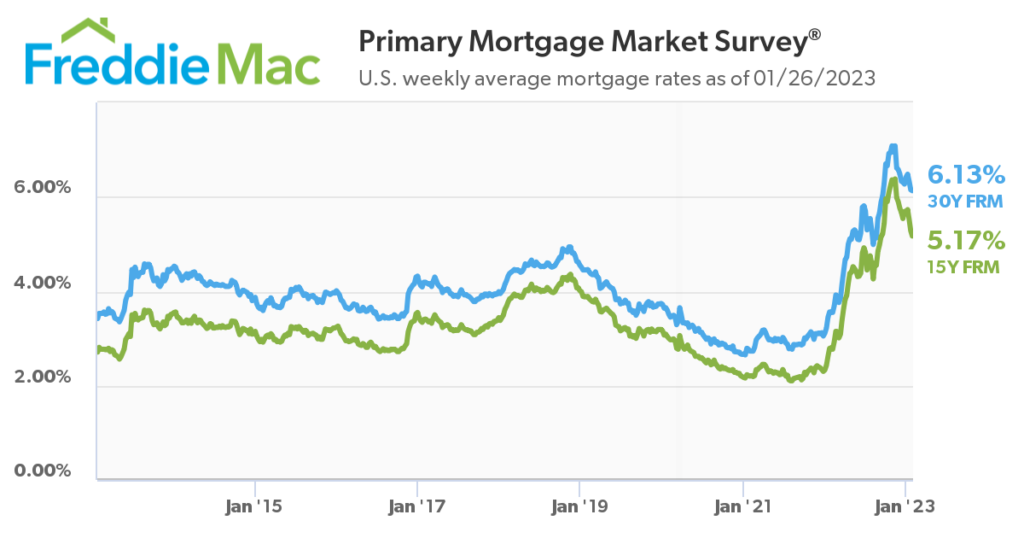

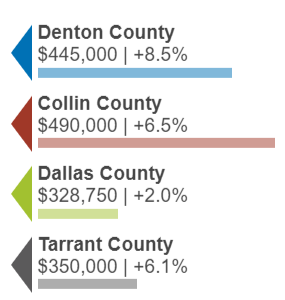

What’s happening in the housing markets? Well, 2022 started out with a bang as prices soared like a rocket. The rocket soon turned and begin its descent in May as mortgage rates began to rise in March. Mortgage rates impact housing as they affect buying power. Mortgage interest rates peaked in November and have been hovering around 6 % for the 30-year fixed rate. Some of the price declines are a part of seasonality but there is no question that this rapid increase in mortgage rates has caused price declines.

To get an idea of how dramatically the mortgage rate increases have occurred in the last 6 months, take a look at this 10-year history of mortgage interest rates.

As we look at the housing market for 2022, a clear shift has occurred. Gone are the days of bidding wars and multiple offers. Sellers have been in charge as buyer demand was fueled by historically low mortgage interest rates. In April, the majority of homes were selling over the list price. Now we see more price reductions and homes closing below list price.

Supply has increased, but is still very low as less than 3 months supply in any market. Fewer existing homes have been put on the market as homeowners are holding on to the low rates in their current loans. Inventory is down from the previous month but up from the same time last year. So, although prices have been declining, the market is not tanking. The market has been at the extreme end of high price appreciation and is now headed toward more stabilization. We will soon be seeing the spring market and it will be interesting to see where mortgage rates are going to be and how confident buyers and sellers will be in the spring market.

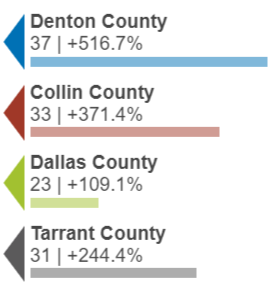

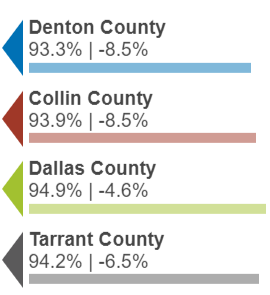

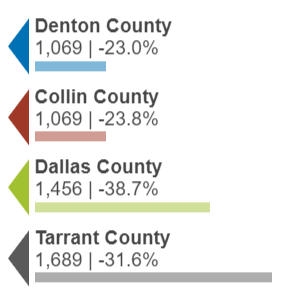

Here’s the data:

Median Sales Price

Months of Supply

Days on Market

Percent of Original Price

Volume

Read📖

Real estate trends to watch in 2023– Sacramento Appraisal Blog

Appraising Small Income Properties– McKissock Blog

Sad News About a Member of Bradford Technologies-Bradford Technologies

Torturing housing stats to say what you want- Sacramento Appraisal Blog

Dallas-Fort Worth’s 38% Decline in New Home Construction Is the Largest Since 2009– MetroTex

HUD Announces Numerous Changes to Handbook 4000.1– McKissock Blog$1.75 Million Allegedly Paid to Two “Favored” Appraisers. Is Valuation Independence Good or Bad for Business?-Christensen Law Firm

Keeping Housing Above Water– Housing Notes

Was This Home Overimproved or Underimproved?– Cleveland Appraisal Blog

How Was The Housing Market in 2022?-Birmingham Appraisal Blog

Can Expert Analysis Save Appraisers? – George Dell

Listen🎧

USPAP and Non-Traditional Appraisals- Tim Anderson’s TAA Podcast

What Has Changed Since Covid with Appraiser Education?– The Appraiser Coach Podcast

USPAP and Enough Iterations – TAA Podcast 099- Tim Anderson’s TAA Podcast

Watch📺

Webinar: First Signals for the 2023 Real Estate Market- Altos Research

2023 Housing Outlook: The Economic Indicators All Appraisers Should Monitor– Appraisal Buzz/Datamaster

HW+ Housing Market Update– Logan Mohtashami/Mike Simonsen

So as we prepare for the next 3 days of a winter storm here in North Texas, we wish you safety and warmth. We will continue to follow all that is happening in real estate. As always, if you have questions or need appraisal services, we are here for you!

It’s good to see buyers having more control. And now we’re heating up for the spring. It would be so healthy for buyers to continue to flex power. Here’s to watching the market closely. It’s always moving…

Yes! Thank you Ryan. 3 of my kids bought their first home in the past 2 years and they all had to deal with bidding wars. It’s good to see us come out of that environment. It will be interesting to see what happens with this Spring market.