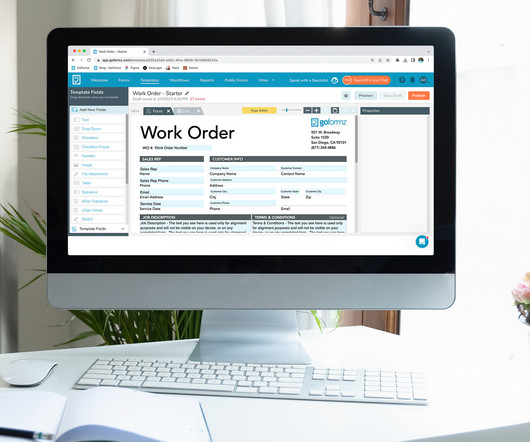

Fintech Maxwell launches POS feature that offers tailored workflows for lenders

Housing Wire

MARCH 12, 2024

Unlike off-the-shelf POS solutions, Blueprint Builder allows lenders to customize technology that is designed to help improve operations, Maxwell noted. Since launching in 2016, Maxwell has used technology to streamline and accelerate the mortgage process for more than 300 banks, credit unions and other lenders on its platform.

Let's personalize your content