The screeching you heard in June was the sound of brakes being applied to the housing market across the U.S. Except for crypto, the rising cost of nearly everything – gas, groceries and going to see grandma – has forced many of us to recalibrate our finances.

Our shrinking wallets have people delaying bigger purchases or at least looking for bargains when possible – including homes. The King County housing market has seen inventory increase by 55% in the past month, while the number of homes going under contract fell 22% from May to the lowest June level since 2011. This, coupled with a significant portion of homeowners standing pat with mortgages at or below 4% interest (and other factors) is causing the market to lose steam.

“Housing … will typically decline before the rest of the economy, and we’re seeing evidence of that now,” says Rob Dietz, chief economist of the National Association of Home Builders. “It’s going to be the first one to show weakness, and it’s going to be the first sector to show a rebound.”

Home shoppers often focus on the direction of mortgage interest rates, which have jumped more than two percentage points this year alone to a range of 5.75%-6.75% for 30-year conventional financing. (Rates vary based on many factors, including an applicant’s qualifications.) Economists believe that as long as inflation is running hot – at a whopping 9.1% annualized nationally and 10.1% in Seattle metro for June – mortgage rates will remain high. Economists say the combination of high home prices and inflationary costs has placed about a 51% added cost burden than only a year ago.

“We’re well aware that mortgage rates have moved up a lot, and you’re seeing a changing housing market,” Jerome Powell, the Federal Reserve chairman, said last month. “We’re watching it to see what will happen. How much will it affect housing prices? Not really sure.”

Not exactly reassuring.

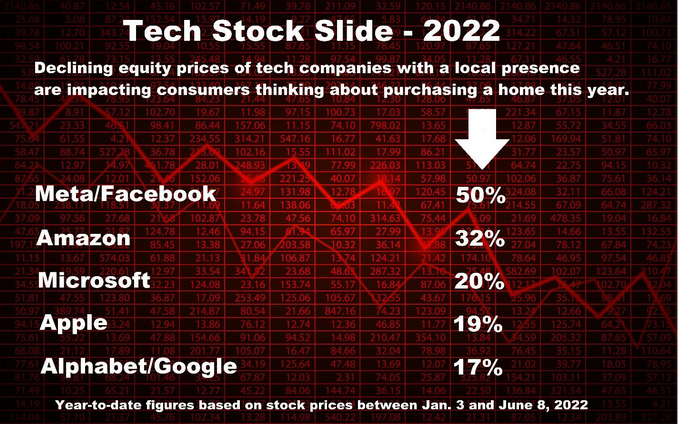

Even stock investments, the source of many down payments for buyers, have taken a heavy blow. U.S. equities suffered their worst first-half performance since 1970, with the S&P 500 entering bear market territory by losing 21% of market value from the start of the year to July 1. The tech-heavy Nasdaq has been hit especially hard, having lost 31% of its value since reaching an all-time high last November.

Local Meta and Amazon employees planning to unlock their investment portfolios to purchase a home may be rethinking those plans as their company stock prices have plummeted this year. In fact, most tech companies in our county – and many of their employee shareholders – have taken a financial hit in the first six months:

Softening the blow at Amazon, the e-commerce and web services giant reportedly doubled the number of stock awards – known as restricted stock units – issued to employees and significantly increased base salaries this year. And competition among tech firms for talent has helped spark generous salary increases for the benefit of more local workers.

The increasing salaries and stock offerings for this group are helping to keep the housing market moving forward – though at a much slower pace. To be sure, more prospective home buyers are watching from the sidelines until the economy improves.

Higher interest rates, growing inflation, soaring fuel costs and a declining stock market all threaten the housing market for some time. The second half of the year will look much different than 2021. For more information on where the economy and local housing market is headed, flip over to my blog for a recently published article with charts and analysis.

FOR FIRST-TIME BUYERS, NOW WHAT?

For Millennials now in their formative home-buying years, the changing economic environment is something never before seen in their lifetime. This group is arguably the hardest hit by inflation because they are in the life stage needing (or at least wanting) to shell out more for big-ticket items.

People aged 25-41 are typically purchasing cars, going on world-exploring trips and, yes, considering buying their own home. This is the same generation that went through two recessions and is quite possibly shouldering student loan debt.

“[This] creates a lot of problems for the big steps that are anticipated as people age from their 20s, into their 30s, into their 40s, when you think about goals of family formation and relationship building,” Cliff Robb, a professor of consumer science at the University of Wisconsin, told Marketplace.

Millennials are 43% of the home-buying pool in the U.S. and the main source of first-timers but, with everything rising – inflation, home prices and interest rates – they understandably may need more time to get their financial house in order.

The portion of first-time buyers among the pool of U.S. home sales has fallen from 31% in May 2021 to 27% today. U.S. Census data show only 24% of under-35 households in King County are homeowners, down from 30% at the start of this century, while the wider Millennial generation has a 36% ownership rate in our region.

The median income for Millennials who are actively buying or intend to buy a home soon is about $82K, according to the National Association of Realtors® (NAR). That compares with an average salary of $47K for the entire generation nationally and, unofficially, $58.4K in our region.

Millennials may be better equipped to handle these major challenges for two reasons. Low unemployment (2.2% in King, as of May) has helped improve competitive pay in many job sectors – especially in our tech-centric county. And the number of homes on the market has increased significantly in recent months, offering more selection than before the pandemic, while price appreciation is slowing.

Economists and demographers agree that Millennials, the largest generation ever, will drive the housing market for another decade or more. They will likely need a little more time, though, to get into their first homes during these extraordinary times.

BY THE NUMBERS

>> The monthly principal and interest payment on the average-priced U.S. home with 20% down is 44% more than it was at the start of this year, according to data from real estate analytics firm Black Knight. It now takes 34% of the median household income to make a monthly payment on an average-priced home in the U.S.

>> A survey of 1000 homeowners found that 77% experienced unexpected repairs in their first year of ownership. More than half (53%) spent in a range of $1000-$5000 on repairs, according to the survey.

>> Washington has some of the highest closing costs for home buyers, averaging $13,926 in 2021, according to a report from CoreLogic’s ClosingCorp. Closing costs for U.S. buyers seeking a mortgage shot up 13% in a year across the country, shelling out an average of $6905. Washington, D.C., had the highest average ($29,888) and Missouri the lowest ($2061). Among metro areas, Bremerton-Silverdale had some of the highest average closing costs in the nation – $16,003.

>> It takes 36% of the U.S. median household income to make a mortgage payment on the average-price home purchase, well above the 34% peak in July 2006, according to data from real estate analytics firm Black Knight. The average home price is now more than six times the median household income in the U.S.

>> Washington, at 6.6%, was among the leading states to experience an increase in tech worker jobs from pre- to post-pandemic (December 2019 to December 2021). Only Tennessee (7.6%) and Idaho (7.5%) had a larger percentage increase in that time, according to a report from the Technology Councils of North America. The report also stated Washington, at 44%, had one of the widest hiring gender gaps for tech workers with Utah (60%) being worse. A full 78% of all Seattle area tech workers are male.

>> When examining the top 20% of most-affluent households among major U.S. cities, Seattle ranks fourth with an average income of $345,000. That’s according to Census Bureau data averaged out over the five years between 2016 and 2020 and reported by The Seattle Times. San Francisco had the highest average income among the top 20% of that city’s population, at $444,000, followed by Washington, D.C., and San Jose, Calif.

>> A record 700,000 units in large apartment communities were leased-up in the 12 months ending Q1, more than double the nation’s historical norm for apartment demand. In reporting its findings, John Burns Real Estate Consulting said the increase comes from pent-up demand from college graduates who were living at home through the pandemic lockdown, roommates decoupling for more space and more people living alone. (A property lease-up refers to the time a new apartment announces its open date and runs for 6-12 months.)

JULY HOUSING UPDATE

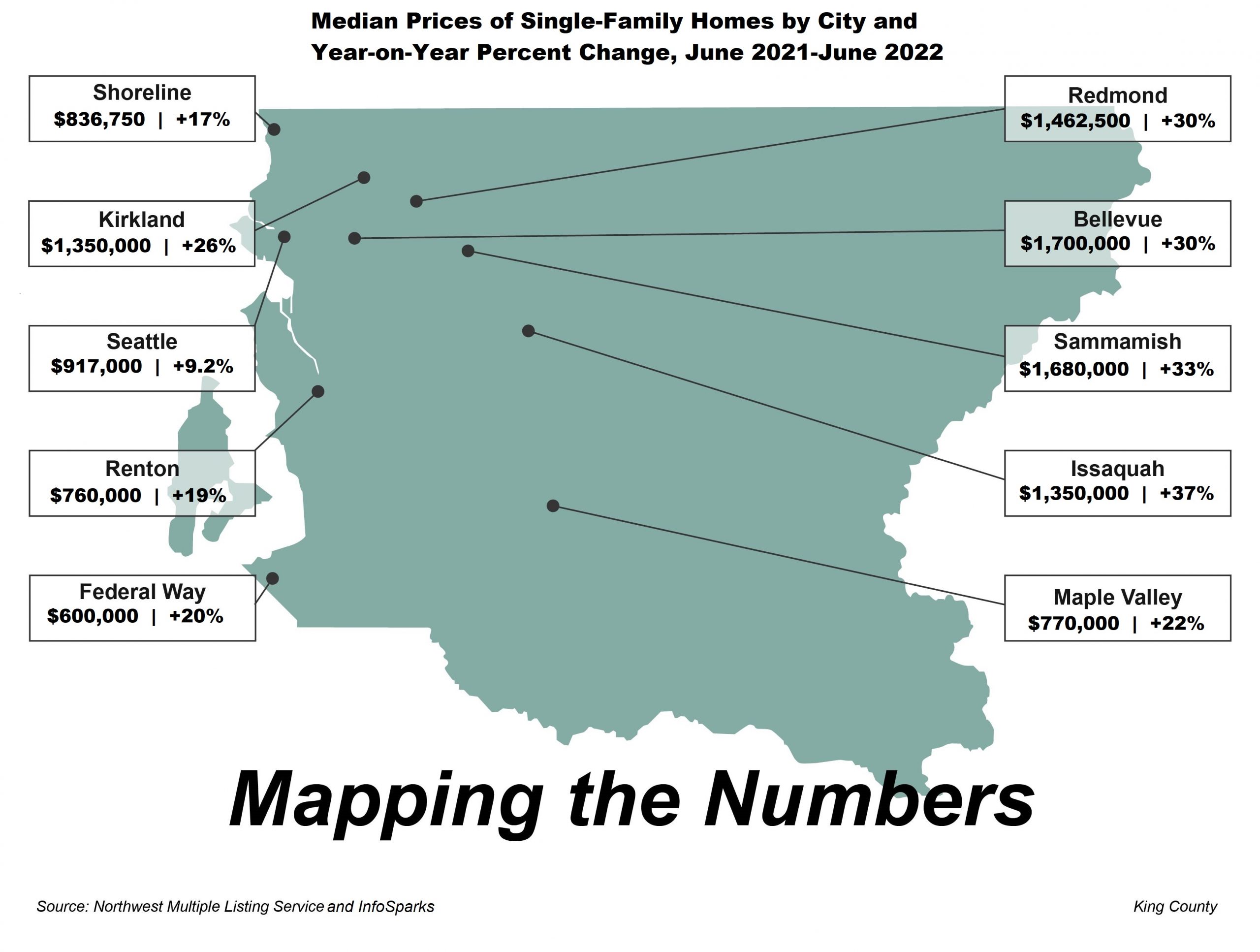

Buyers who can afford to purchase a home are rejoicing as Northwest Multiple Listing Service data for June confirmed a sharp increase in available inventory and a month-to-month drop in median sales prices. The fresh data also show a clear slowing of the housing market.

While the number of new listings in June jumped 8.2% for the month across King County, homes still on the market at the start of July soared 55% (4207 units) from June 1, or 86% higher than this time last year. Single-family homes show similar increases in the county, up 8.2% in new listings and 57% in active listings at the start of this month (3256), up 124% from a year ago.

Digging deeper, Southwest King (Federal Way, Auburn) saw the sharpest increase in available listings of all homes (395), up 80% from May and 124% year on year (YoY). Seattle homes on the market as of July 1 increased 53% (1420) and by 16% YoY. Total Eastside inventory rose to 1366 active listings, up 52% in one month and 210% in a year.

The single-family-home category saw similar results: Southwest King (up 79%) and Southeast King (Enumclaw, Maple Valley) (54%) saw the greatest increases regionally in existing listings. Eastside available inventory rose 48% from May to June and Seattle added 67% in a month.

The 1336 new single-family-home listings in Seattle for June are the third-highest for any month over the last 12 years, signaling a rush by sellers to get homes on the market as quickly as possible. May 2019 (1409) had the highest number of new monthly listings in the last dozen years, followed by June of last year (1351).

Meantime, Pending listings (homes under contract) fell 22% month to month across the county for both single-family homes and condos, while closed sales of all homes fell 4.2% since May and down 22% YoY. Declining Pending home sales at the traditional peak of the year is a sure sign of a slowdown. In addition, for every 100 homes sold in the three-county region (King, Snohomish, Pierce), 21 did not in June; that’s up from an average of five unsold homes a month per 100 sold in the first four months of the year.

That means prices are cooling too. King County median prices slipped 3.3% across all home types from May to June ($851,000) but remain up 9.1% YoY. Median prices dropped 4.2% in the past month in North King County ($876,250) and are up only 0.1% for the area (Shoreline, Lake Forest Park) over the last 12 months. Seattle home prices fell 1.3% for the month ($887,500) and are up 11% for the year, while prices of all Eastside homes dropped 7.1% in June ($1.3M) and are up 13% YoY.

In the past month, single-family-home prices weakened 6.1% ($938,225) for King, declined 2.5% ($1M) for Seattle and fell 5.7% ($1.5M) on the Eastside. For the year, single-family prices remain higher – up 9.1% across the county, 12% in Seattle and 10% on the Eastside – but by slimmer percentages from readings earlier this year and in 2021.

For condo activity, King County inventory gained 50% in the month (951) and is 19% higher for the past year, while available Eastside units are 67% higher month to month (261) and up 71% YoY. Seattle experienced a 36% rise in existing condo homes (577) from May and up 3.2% for the last 12 months. Seattle’s 508 new listings for June were the second highest of any month over the past 10 years – one shy of tying the high mark set in August 2020.

Pending condo sales (21%) and closed sales (12%) were both down by significant margins from May, most notably a 38% monthly decline in sales for downtown Seattle’s luxury home market. Condo prices stand at $525,000 for all of King, down 1.1% for the month but 14% higher YoY. Prices for Eastside condos fell 5.6% in one month ($622,400) and remain 12% higher from last year. Seattle condo prices are 3.4% weaker in the past month ($538,700) and up 7.7% YoY.

Supply measured by months of inventory climbed across King County from 0.8 in May to 1.3 for all homes combined, as well as only single-family units. That equates to about 40 days’ supply if no other homes came on the market, a remarkable climb in only a few short weeks. Seattle now has 1.3 months’ inventory for all home types, up from 0.8 in May, while the Eastside is enjoying 1.5 months’ inventory, up from 1.0 a month ago. The Emerald City also has 1.1 months of single-family inventory, up from 0.6 in May. Eastside single-family inventory stands at 1.6 months, up from 1.0, with Kirkland and West Bellevue/Medina registering inventory above 2.0 months – unsurprising, as a market slowdown typically starts with higher-priced addresses.

“Home sales have essentially returned to the levels seen in 2019 – prior to the pandemic – after two years of gangbuster performance,” NAR Chief Economist Lawrence Yun said. “Also, the market movements of single-family and condominium sales are nearly equal, possibly implying that the preference towards suburban living over city life that had been present over the past two years is fading with a return to pre-pandemic conditions.”

Elsewhere in the Puget Sound region, the Kitsap housing market received a jolt thanks to the sale of seven $1M condo townhomes in a new community called 275 Degrees in Bainbridge. Those sales were among 21 Kitsap homes sold in June priced in a $999K-$2.4M range – all condos, including some custom live/work residences. The wave of sales sent the county’s median price up 19% YoY and 9.6% for the month ($603,025) for all home types, up 18% YoY and 8.2% for the month ($600,000) for single-family homes and up 59% YoY and 88% for the month ($685,000) for condos.

This, in turn, has allowed Kitsap to leap past Pierce as the third-priciest county in our four-county region. Pierce experienced a 2.6% monthly decline in overall home price ($560,000) but the figure remains 10% above this time last year. Pierce single-family home prices fell 2.3% for the month ($568,575) and are up 10% over the past year, while condo prices rose 2.4% from May to June ($420,000) and are 14% higher YoY.

Elsewhere, Snohomish County saw overall housing prices decline 4.1% in one month ($560,000) and remain 10% higher from a year ago. Single-family prices in Snohomish slipped 1.8% from May to June ($799,950) but are 12% higher from this time last year. County condo prices are down 1% for the month ($500,000) and up 1.6% for the year.

Click here for the full monthly report.

CONDO NEWS

We reported in the May newsletter that three lenders were willing to finance a home purchase at Insignia Towers in Belltown. The information at the time suggested the issue was a high number of owners who were delinquent on their HOA dues – 38 households more than 60 days late on dues totaling more than $88K, as of late June.

It has since been learned that Insignia’s HOA Board filed a complaint in King County Superior Court against Bosa Development, which directed the 698-unit, two-tower project that opened in 2015.

Lenders are reluctant to underwrite a loan to buyers amid pending litigation and a high number of delinquencies. They can also turn down mortgage applicants when condos have a low owner-occupancy rate or when the building is underinsured; neither of these is true in this case.

The complaint against Bosa centers on structural defects in the structures – including apparent leaks from the common-area pool on the 7th floor into the garage. There is no suggestion here that Insignia is experiencing defects of the same magnitude as the 40-year-old South Florida condo collapse a little more than a year ago that included a leaking pool, a deadly disaster that remains under investigation.

The Insignia dispute is scheduled to go to trial in December, though building leadership and Bosa are discussing the issues in hopes of resolving the matter, according to sources with knowledge of the situation. For now, buyers must rely on portfolio lenders – known for holding the mortgage through the duration of the loan – such as Washington Federal to finance a condo at Insignia.

=====

The typical strategy to sell new condo homes is to release a select number of units in stages to manage the flow of transactions. This is particularly true when the total number of residences is in the hundreds such as at Spire.

The 41-story, 343-unit, steel-and-glass tower recently released its final homes to the market, featuring the condo’s penthouse collection of nine residences. The units are on floors 35-39, start at $1.26M and can feature views ranging from the Space Needle, Puget Sound, Olympic Mountains to Lake Union. The penthouse homes range in size from 677 to 2616 sq. ft.

Spire was Seattle’s fastest-selling condominium development in 2021, now with a little more than half of all units sold. It is one of the closest condos to the Needle and is within walking distance of tech giants Amazon, Apple, Facebook and Google. Plus, the building comes with a revolutionary auto-valet parking system.

The Spire sales team is running a special offer through the month: free HOA dues for one year and credit at closing of either $7500 or $15K (depending on the size of the home). Interested in having a look in person? Give me a ring!

LUXURY LIVING

King County is well known for its amazing mid-century modern homes. One of my recent favorites is this 4-bed, 2.5-bath, 3200 sq. ft., 1-story (with basement) home in Kirkland. Built in 1951, it weaves the latest technology into a traditional Northwest home with natural wood floors, stone fireplace and quartz countertop. The landscaped grounds are impeccable. So many nice touches! List: $2.185M ($683/sq. ft.), recently marked down from $2.3M.

The Eastside offers a range of great cul-de-sac neighborhoods with peaceful tree-scaped backyards – including this 5-bed, 3-bath, 4900 sq. ft., 2-story (with basement) custom-built home in Redmond within a short walk of Microsoft. The living room features a vast, brick fireplace and cathedral-like ceiling, with plenty of windows throughout. After hitting the market in early June ($2.595M), the home is now listed at $2.275M ($464/sq. ft.) – a deal in this part of the county.

Seeking over-the-top living? I’ve found something extraordinary tucked away on 5 acres in North Issaquah. It’s a 5-bed, 6.75-bath, 2-story gem with garage space for about a dozen vehicles. Hidden in secluded forested grounds through a short private drive, the journey home soon opens to a manse with traditional designs and custom features. Amazing two-story, coffered ceilings and cathedral-inspired windows stand out in the living room. Waterfall. Fishing pier. Water wheel. Of course! List: $5.65M ($730/sq. ft.)

Think a condo home would better suit you? I have something special! It’s a 2-bed, 2.5-bath, 2055 sq. ft. masterpiece on the 38th floor of Bellevue Towers. The interiors are contemporary and clean – and the views are spectacular. Wake up to unobstructed scenes of the Cascade Mountains and, on a clear day, full-on vistas of sun-splashed Mt. Rainier. Simply breathtaking. Did I mention the two decks that wrap around the building from south to east? You may never want to leave the home. List: $3.2M ($1557/sq. ft.).

Looking to escape to an island compound? Check out this 29-acre private sanctuary in the San Juans. This is quite unique. The property is on the northern tip of little-known Blakeley Island, population under 100. The real estate listing heralds four residences, with a combined seven bedrooms and 6.5 baths on heavily wooded grounds. There is no scheduled ferry service, so you would need to either fly into the resident-owned airpark or arrange boat travel. It’s the ultimate in private Northwest living. Curiously, the owners purchased the property in May 2021 ($7.6M) and are now seeking $8.995M ($1435/sq. ft.) following a recent $1M price drop.

If Mercer Island is more your pace, how does this 1-story (with basement) grab you? The place offers 5-beds, 4-baths, 4315 sq. ft. and co-ownership of a Lake Washington dock. Tastefully designed, the open-plan contemporary home features what I would respectfully call a diner vibe with long kitchen and seating for five at the counter (but no jukebox!). The outdoor deck includes water views and another eating set-up. Now, that’s restaurant quality! List: $4.095M ($949/sq. ft.)

There are manses and then there are museum-level manors. Check out this 3-bed, 3.75-bath, 6658 sq. ft., 2-story stunner (with basement) in Medina. Only the finest materials and exclusive designers were selected for this piece of residential splendor. The main entry made of African Wenge hardwood. Bocce chandeliers. Arakawa systems seamlessly hang any variety of art, as seen in galleries and museums. Walls of windows with UV-coated glass. Custom wood floors that reputedly cost six figures. Italian marble kitchen counters. A den with humidor and ventilation system. TVs in almost every room, all of which stay with the new owners. A main bedroom walk-in closet that includes a washer/dryer(!) … and much more. This modern Medina masterpiece can be yours for $10.75M ($1615/sq. ft.)