Is the dream of homeownership going the way of the dodo? While that may seem like a silly question to ask – especially from a residential real estate pro whose business relies on the purchase and sale of homes – it’s something I have been studying, with some eye-opening findings.

First, let’s set the scene: Housing inventory is shrinking year to year in most parts of the country and there are no signs of significant replenishment over the horizon. It may take decades to backfill stock, which is said to be roughly 4.5M homes shy of what’s needed today.

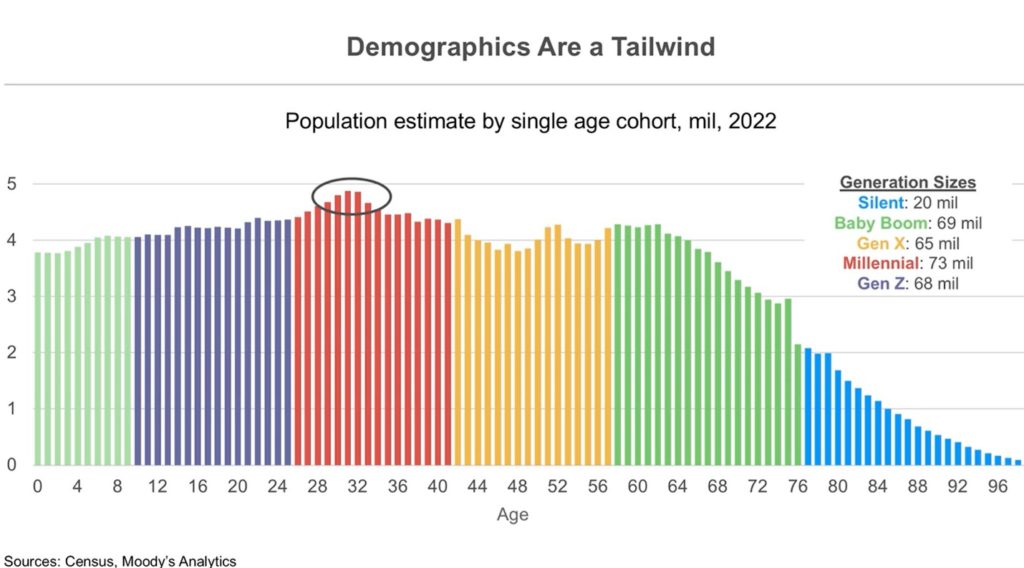

All this, while we prepare to experience in a few years the largest wave of potential home-purchase demand in our nation’s history. As the chart shows, a historically large segment of Millennials is inching toward 36, the median age of a first-time home buyer in the U.S. – also the oldest age of a first-timer ever recorded by the National Association of Realtors® (NAR). For context, a full 40% of Baby Boomers and Gen Xers were homeowners by the time they reached 36.

(Click to expand any image or graphic from my newsletters and blog posts.)

Housing shortages have helped keep home prices and rents high across the country. The share of vacant units for sale, at just 0.8%, is the lowest dating back to the 1950s. Meanwhile, the vacancy rate for rental units, at 6.5%, is lower than it has been since the 1980s, according to Harvard research. With so few available places to live, the competition for those homes is making housing much less affordable for many.

Real estate pros – some of the most optimistic bunch in any industry – acknowledge this is a housing dilemma.

“Buyers have faced a trifecta: historically low housing inventory, home prices that have risen for over a decade and higher interest rates today than a year ago,” says Jessica Lautz, deputy chief economist and VP of research at NAR. “The share of first-time buyers has dropped to a 41-year low [26%], the racial divide in homeownership has grown to the widest point in a decade and the share of single women entering [the market] has declined.”

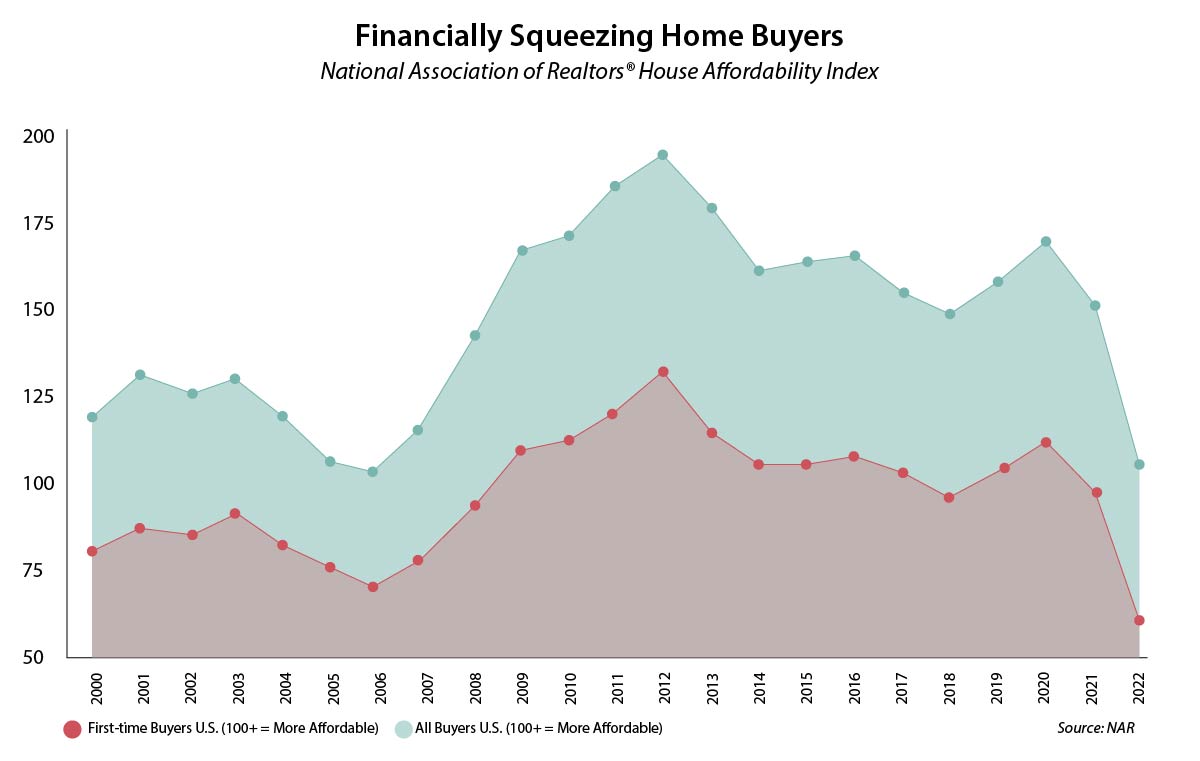

If finding a home isn’t enough of a challenge, affording one can make the purchase experience doubly “exciting.” NAR’s Housing Affordability Index is a good measure of whether a household earns enough to qualify for a mortgage on a typical home. An index score of 100 means that a buyer with a median U.S. income can qualify for financing on a median-priced home. In 2022, the index fell off the cliff:

Homeownership remains a great way to build wealth, especially for the middle class and people of color, who may have few investments. Some experts estimate owning a home can account for two-thirds of the typical family’s total assets.

But many Americans – including Washingtonians – are finding themselves stuck in a cycle of renting, a growingly expensive proposition. A resident in King County reportedly needs to make $40/hour, or $84K a year, to afford a one-bedroom rental while still comfortably covering other living costs.

Forget saving for a home. For many, the question is how to simply survive in one of the costliest places to live. A survey in late July by CBS News showed 35% of Americans are “falling behind” financially, as potential buyers face the prospect of costly rents, car payments and student-loan debt that is again coming due.

In addition, America is taking on more credit card debt, with balances nationwide this summer surpassing the $1T mark for the first time. Can consumers still balance their budget when facing credit card interest rates of 22% on average?

“Something’s got to give,” Mason Virant, associate director at the Washington Center for Real Estate Research at the University of Washington, told The Seattle Times. “Or only the ultra-wealthy are going to be able to afford homes.”

Acknowledging this financial reality, some pockets of Western Washington (and likely elsewhere) are focusing on boosting rental production. The City of Renton reported in June that 92% of the 7800 new units in the permitting pipeline are expected to be market-rate rentals. This follows a decade of producing rentals over traditional for-sale homes in the city by a 3:1 ratio.

Some developers are delivering smaller homes in the form of four- and six-plex townhomes on a parcel of land that once featured a single-family house. Others are specializing in the design and construction of accessory dwelling units (ADUs) as detached backyard homes (also known as “mother-in-laws”).

Among the places getting the housing mix right is Kirkland, a city that features single-family homes with a median sales price today of $1.43M. The Eastside community has introduced something called “gentle density” to the area that includes so-called ADU Alleys which feature affordable garage apartments or some other form of separate home on grounds that are shared with a traditional house.

Redmond, as well, has recently seen a dozen small homes built around a shared open space in what the city calls a cottage neighborhood, making it possible to increase home density without sacrificing the character of a community.

The national trend for new construction, however, is generally moving in the opposite direction. In the 1990s, one-third of new homes were smaller than 1800 sq. ft. Today, that ratio is one in five, as builders target consumers seeking larger homes.

Enough buyers appear to be willing to pay a premium for extra space to include a home office and bigger backyard for their garden – evolving from a “want” to a “need” since the pandemic changed how we live and work. The price of new construction has jumped, too; the National Association of Home Builders estimates costs have risen about 35% since 2019.

Fortunately, we have neighbors helping neighbors at all price points when possible. And for those not willing to embrace affordable housing in their immediate area, consider this: A 2022 study shows the value of homes near affordable housing increases.

Ah, yes, the pandemic. It can be blamed, rightly, for millions of lives lost, families altered forever and, as we are witnessing, an evolutionary time in our housing world.

After peaking in 2004 at 69%, this country’s homeownership rate has slipped to 66%. Yes, owning a home is still a goal of many – at least for two-thirds of the country – but there are signs of cracks in that thinking.

Change can be hard and painful. It can also be beautiful and refreshing – or many combinations of emotions. We need to take an approach to the housing crisis that embraces change, is inclusive and extremely productive.

BY THE NUMBERS

>> The West has suffered the greatest from the housing-market downturn over the past year, according to ATTOM Data Solutions, which indicated 23 of the 50 worse-off U.S. counties are in our region. That included seven counties in Oregon, mostly in or near Eugene, and five in Washington – Skagit, Clark, Cowlitz, Spokane and Yakima counties. The research examined median home prices, the percentage of homes facing possible foreclosure, the percentage of average local wages needed to pay for major home-ownership expenses, and the portion of homes with mortgage balances that exceeded property values. None of the Seattle-area counties were on the list.

>> Bellevue is rated No. 3 as the best medium-sized city for tech workers to live, according to research from virtual learning company Forage. In reviewing the top 94 cities with populations between 100K and 150K, Forage looked at nine categories – from average pay for software developers to broadband availability and cost-of-living factors – to rank the areas. Bellevue has an average hourly wage for developers of $74.85. Renton ranked 5th in the nation, with Santa Clara, Calif., and Palm Bay, Fla., leading the list.

>> Seattle ranked second in the nation for best places to start a career, according to Bankrate.com, which looked at affordability, employment opportunities, long-term career potential and overall quality of life. The Emerald City was first for employment opportunities. Austin, Texas, earned the overall top spot from the personal finance website.

>> In an analysis by Axios, it takes the typical Seattle resident 13 years to save up for a 10% down payment on a home. Using home valuations and area median household income data, the report notes the average time required across the U.S. is 8.9 years, assuming prospective buyers save 5% of their household income each month. With a median household income of $106K and a typical home value of $703,600, Seattleites can expect to spend a “baker’s dozen” years to reach the 10% down payment threshold. The average time across Washington is 12 years and it takes 12.7 years in Portland metro. Conversely, it requires Iowa residents only 5.2 years to reach the 10% mark.

>> Newly built homes (excluding resales), at an average price of $635,131 in Washington, are out of reach for an estimated 81% of state households. That’s according to the Housing Affordability Index released by the Building Industry Association of Washington. About 97M U.S. households cannot afford a median-priced home.

>> The Emerald City ranks 5th in the country when it comes to housing development over the past 10 years, according to a report from StorageCafe, which used data from the Census Bureau. The report found that 91.3K building permits were granted in Seattle between 2013 and 2022, with 85K of them for multi-family construction. New York City saw the most development over the past decade, with 98% of its 242K permits comprised of multi-family units.

AUGUST HOUSING UPDATE

The local market appears to be sleep-walking through a year that will be best known for near-record-low activity and prices higher than at the start of the year. The season has been shaped by slumping new listings, a slowly climbing number of homes sitting on the market from previous months, fewer closed sales compared to last year and prices moving plus/minus five percentage points year-on-year (YoY).

The single-family housing market is sluggish, as many prospective buyers and sellers have chosen to focus on enjoying the many weeks of beautiful weather. King County new listings fell 13% from June to July (2158), led by a 20% slide in Seattle (690). The county has not seen a July figure this low since records have been archived for brokers in the early 2000s; the previous low of 2512 single-family new listings in July occurred in 2012.

Read a detailed assessment of our housing market in my most recent blog post: King County Home Buyers and Sellers in ‘Re-Evaluation’ Mode

CONDO NEWS

Graystone, the next big condo unveiling in Seattle, has had a strong response to the offer of on-site tours inside the building project. The sales team has now added a second day to their schedule. In addition to Saturday hard-hat tours, which have been a big hit, the agents are making more available on Wednesdays. (Contact me for sign-up details.)

Buyers have been energized after the sales team announced in May a reset on pricing – now starting in the low $400,000s – and incentives to help reduce the buyers’ bottom line. Depending on the size of the home, buyers will receive up to $25K off to help defray the cost of the parking space, lower the mortgage interest rate, reduce closing costs or simply to further reduce the price. Wow!

The building developers, Seattle-based Daniels Real Estate, is preparing to announce a delay in opening the grand 31-story condo on First Hill. It is now expected to open in Q1 of 2024 to allow a few construction delays to be ironed out. The 271-unit high-rise was expected to open this summer but – like other condo projects in recent years – various issues crop up to delay the final product. I am told there are no major issues but Daniels wishes to wait until the building is fully ready for its close-up!

Coincidentally, Q1 of 2024 is the last known date of completion on another major project – First Light, on the south edge of Belltown. According to a July message from the sales team, concrete for 44 of the 47 stories has been poured and the topping off of the project should be forthcoming. Project updates have been few and far between for this 459-unit, super-luxe, mixed-use condo tower. The amenities include a roof-top infinity pool.

————

The civil complaint filed by homeowners of Insignia Towers against building developers continues to move toward a Nov. 16 trial date at King County Superior Court. However, we have learned that more than half of the issues raised in the complaint have been resolved against about a dozen subcontractors of Bosa Development Washington.

In legal filings, Insignia homeowners claim Bosa and its subcontractors are responsible for defects or deficiencies in a range of materials, design and construction. Bosa developed the twin, 41-story, 698-unit community in 2015-2016. The homes sold out quickly and remain a popular destination with outstanding amenities.

People looking to buy a home at Insignia will need to pay cash or work with a specialist lender such as WaFd Bank. Traditional lenders generally do not underwrite mortgage loans on multi-family home purchases linked to active litigation.

LUXURY LIVING

The $85M Hunts Point estate that we reported here in May 2022 is back on the market at a steep discount – relatively speaking. The 5-bedroom, 7.75-bath, 11,150 sq. ft. mansion with three additional buildings was the highest-priced listing ever at the time. New price: $70M ($3978/sq. ft.). The property sits on 4.3 acres and includes 327 ft. of waterfront. The 2-story residence was built in 1995 and features wide-plank wood flooring, impeccably designed interiors, radiant floors, HEPA air filtration and eight fireplaces. The grounds have a tennis court and outdoor pool. Other buildings include a 4545 sq. ft. staff quarters, 1500 sq. ft. cabana and 400 sq. ft. beach house for a total living space of 17,599 sq. ft. Go big and go home! The Seattle Times and others report telecom magnate Bruce McCaw is the owner and that he purchased the estate from world-renowned saxophonist Kenny G. The 18% discount from last year’s price dropped the Hunts Point residence into second place for priciest listing in our area behind a $75M estate for sale in Friday Harbor.

The $85M Hunts Point estate that we reported here in May 2022 is back on the market at a steep discount – relatively speaking. The 5-bedroom, 7.75-bath, 11,150 sq. ft. mansion with three additional buildings was the highest-priced listing ever at the time. New price: $70M ($3978/sq. ft.). The property sits on 4.3 acres and includes 327 ft. of waterfront. The 2-story residence was built in 1995 and features wide-plank wood flooring, impeccably designed interiors, radiant floors, HEPA air filtration and eight fireplaces. The grounds have a tennis court and outdoor pool. Other buildings include a 4545 sq. ft. staff quarters, 1500 sq. ft. cabana and 400 sq. ft. beach house for a total living space of 17,599 sq. ft. Go big and go home! The Seattle Times and others report telecom magnate Bruce McCaw is the owner and that he purchased the estate from world-renowned saxophonist Kenny G. The 18% discount from last year’s price dropped the Hunts Point residence into second place for priciest listing in our area behind a $75M estate for sale in Friday Harbor.

While we’re in the neighborhood, here is an opportunity to build your own lake house. The existing 6-bed, 2.5-bath, 3560 sq. ft., 2-story, Yarrow Point home (with basement) is lovely for its 95 years, but, as you can perhaps see from the layout, the 0.6-acre grounds would certainly look fetching with something brand new. And the sellers don’t disagree. They were going through the permitting process on a new home with detached guest house/garage but, instead, are moving on. What an opportunity to benefit from the vision of the current owners or to create something from scratch along the 55 ft. of waterfront! List: $11.2M ($3146/sq. ft.)

A beautiful home in Renton caught my eye. It’s a 4-bed, 3.5-bath, 4550 sq. ft., multi-level, custom-built beauty. The home offers plenty of water – an in-ground pool, outdoor spa tub and 67 ft. of Lake Washington shorefront. (The listing video may make you a little seasick, however!) This place has everything … and it comes with everything. The sale includes all home furnishings, such as furniture, player piano, custom murals and ski boat. Don’t forget the boat house and helipad! List: $5M ($1099/sq. ft.)

A lot of time and creativity were invested in a very special Seattle home. There is a sense of symmetry and precision with the layout of this 2-bed, 1.75-bath, 2610 sq. ft. residence at Continental Place, one of the city’s first purpose-built, high-rise condos (1981). The home was reimagined by local architect Garret Cord Werner and features tray ceilings with recessed lighting, heated limestone flooring, window benches, red-leather-floor entry, Murphy bed in the second bedroom/library, ventless fireplace and three deeded parking spaces with room for four vehicles. There are 270-degree views of Mt. Rainier, Elliott Bay and the Space Needle. Building amenities include a two-bedroom guest suite, indoor pool, spa tub, fitness center and parklet. A masterpiece awaits! List: $3.78M ($1448/sq. ft.)

And we cap this month’s look at luxury listings on Lake Sammamish – which is pictured atop this month’s newsletter. This 4-bed, 5.25-bath, 4727 sq. ft., 2-story (with basement) includes 75 ft. of north-facing lakefront in beautiful Issaquah. A perfect open-plan home in an idyllic setting: granite counters accent the rich-wood flooring in the chef’s kitchen, French doors from the casual eating space open to a patio with an unobstructed water view. Add in the sports court, spa tub and dock and you have everything you need for years of fun outdoors and in. It has to be seen to be appreciated. List: $6.3M ($1333/sq. ft.).

What else is happening in and around your Seattle?

Lighted Art Show, Aug. 18-19

Come to Kent and see 30 art installations that blend light and sound into family friendly fun. Lusio Lights is free at Mary Olson Farm (28728 Green River Rd.). No dogs, food or drink on site. 7-11pm

Railroad Fest … and More, Aug. 19

Snoqualmie Days has a pancake breakfast (7-11am), 5K run (8am), train rides (11am, 1pm, 3pm), parade (11am), music (12:15-10pm), vendors and entertainment on car-free streets surrounding Northwest Railway Museum (38625 SE King St., Snoqualmie). Speaking from personal experience, the pancake breakfast is yummy!

Party in the Park, Aug. 25

Seattle Art Museum presents SAM Remix. The event promises “light and sound installations, live music, and art making” with food for sale and a no-host bar at Olympic Sculpture Park (2901 Western Ave., Belltown/Seattle) 21+ with ID. 8pm-midnight

Rodeo, Aug. 25-27

Watch cowboys and cowgirls compete in bull riding, buckin’ broncs and steer wrestling at the Enumclaw Rodeo. The professional rodeo was established in 2012, returning a 70-year tradition to this southeastern King County city. Check it out at Enumclaw Expo Center (45224 284th Ave. SE). Various times.

Princess Picnic, Aug. 27

Your child can meet princesses Beauty and Rapunzel, hear them sing and read stories, and eat a Princess Picnic in this one-hour event at Lake Wilderness Arboretum (22520 SE 248th St., Maple Valley). 12pm

Video Game Convention, Sept. 1-4

Play pre-release video games, attend interactive panel discussions, watch game competitions and admire gamers in costume at PAX West. One of the nation’s biggest gaming confabs of the year takes place at Washington State Convention Center (705 Pike St. in Seattle).

Do the Puyallup, Sept. 1-24

Take part in the annual pilgrimage to Puyallup for the family friendly event of the year – the Washington State Fair, the largest and oldest in the state. Plus, catch a concert or two; some of the headliners: Chicago (Sept. 1), Kane Brown (Sept. 3), Zac Brown Band (Sept. 13), Pentatonix (Sept. 16) and Babyface (Sept. 23). Washington State Fair Events Center (110 9th Ave. SW). Various times. Closed Tuesdays.

Free Seattle Concerts, Sept. 2-14

Did somebody say free music? Yep! See – and listen – for yourself – Ballard Locks (Sept. 2-4, 2pm); Bell Street Park (Sept. 8, 5pm), Downtown (Sept. 5-7, 12pm and Sept. 8, 5pm) and Pier 62 (live DJ, Thurs., 4:30pm)

Mexican Market, Sept. 9

Festival Xopantla Tianquiztli features arts & crafts vendors, street-style Mexican food, tequila-inspired drinks and traditional dance at Pier 62 (1951 Alaskan Way in Seattle). Free entry. 1pm

Seattle Seahawks 2023 Kickoff

The Seahawks open their 47th NFL campaign at home on Sept. 10 against the L.A. Rams (1:25pm). There is great promise for this year’s team, led by quarterback Geno Smith and returning linebacker Bobby Wagner. The Hawks – like most teams this season – will play on Christmas Eve (at Tennessee) and New Year’s Eve (vs. Pittsburgh). Tickets

Tour Modern Homes, Sept. 16

Seattle Modern Home Tour is a self-drive exploration of six contemporary houses in Seattle and the Eastside. You may even get a chance to meet the homeowners and architects. 10am-4pm

Events are subject to change. Please check with venues to confirm times and health-safety recommendations.

In case you missed it….

The Living the Dream blog enjoyed a two-week break in July and returned with two stories related to housing and aging:

Preparing a Home to Safely Age in Place

Eight Home Renovations to Make Before Retirement

I appreciate your readership and kindly ask that you forward this monthly report as a special gift to one of your friends or colleagues. They can sign-up for future missives here. Thanks and see you in September!