Will mortgage lending get tighter in the next recession?

Housing Wire

JULY 6, 2022

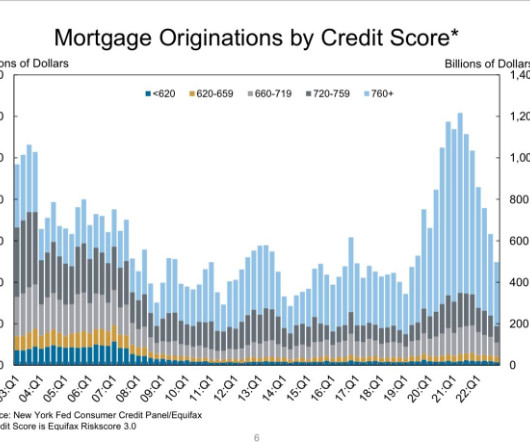

As recession talk becomes more prevalent, some people are concerned that mortgage credit lending will get much tighter. One of the biggest reasons home sales crashed from their peak in 2005 was that the credit available to facilitate that boom in lending simply collapsed. The short (and long) answer is no, not a chance.

Let's personalize your content