Wouldn’t it be great if we lived in a place where most major conveniences were within 15 minutes?

The pandemic has caused many of us to rethink where we live – some now seeking more space for zooming, streaming and enjoying the outdoors. Others are in pursuit of a tight-knit community that has a market, pharmacy, restaurants, coffee shop – and an amusement ride like our Great Wheel (just kidding!) – within a short drive, transit ride or easy walk.

Urban planners have a name for it: the 15-minute neighborhood and it is already in development in parts of the country, including Seattle. The main goal is to give back time to people who wish to live in an environment that promotes community over commuting, harmony over stress.

This is hardly a new concept. Just look at major metros around the world – London, Paris, New York City – and they have followed this principle within the city limits. Okay, perhaps the stress is higher but neighborhoods within those cities are generally tight-knit areas with a personality all their own.

“We envision a country where no matter where you live, or who you are, you can enjoy living in a place that is healthy, prosperous and resilient,” Calvin Gladney, CEO of Smart Growth America, told a group of Realtors® in D.C.

In calling for rezoning laws to accommodate this concept, Gladney identified five keys that communities should keep in mind when designing their 15-minute neighborhood:

- Think in terms of mixed-use development, such as a blend of housing, commercial usage and small-scale manufacturing.

- Make sure residents can get to their employer and to a jobs center.

- Plan ways for people to get around, whether they are walking, biking or rolling (including wheelchairs).

- Create options for multiple modes of transport – bikes, cars and transit should all be factored in.

- Promote racial and income equity. Affordability and attainability won’t just happen; they must be baked into the plan.

David Goldberg, chair of the Land Use & Transportation Committee of the Seattle Planning Commission, is helping to lead the city’s own 15-minute neighborhood. A pilot program is in development for the Westwood-Highland Park area (also known as South Delridge), where a new farmer’s market started this year and it will soon be served by the new RapidRide H Line bus route. With Link light rail expanding, it may be easier to achieve more of these 15-minute areas – such as in Northgate, Roosevelt or Kent.

The writer/journalist Italo Calvino once penned: “You take delight not in a city’s seven or 70 wonders, but in the answer it gives to a question of yours.”

Cities and neighborhoods are where we all should answer our questions about home and community. Where would you like to see this type of neighborhood development? Send me a message.

——-

In last month’s newsletter, I shared eye-opening stats from a survey of 5,000 U.S. adults: 42% of full-time remote workers say they are planning to move over the next 12 months and 26% of on-site workers are making similar preparations. The top reason for moving: They want to own a more affordable home. Makes sense!

In last month’s newsletter, I shared eye-opening stats from a survey of 5,000 U.S. adults: 42% of full-time remote workers say they are planning to move over the next 12 months and 26% of on-site workers are making similar preparations. The top reason for moving: They want to own a more affordable home. Makes sense!

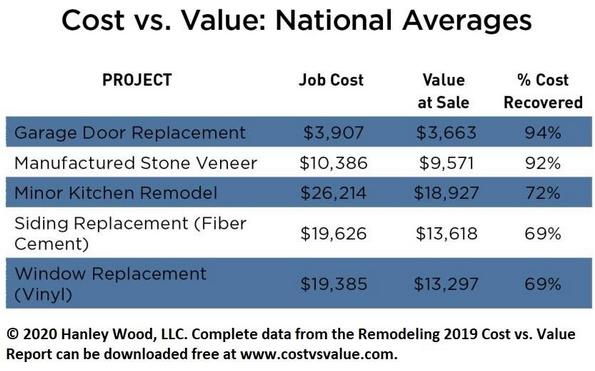

Well, researchers at realtor.com went a little deeper to find out what those consumers are seeking when looking for a new home. In addition to “more space,” prospective buyers are on the hunt for a quiet location (28%) and updated kitchen (25%), as the chart notes. (Click on the graphic for more details.)

——-

THE ROI OF HOME RENOVATION

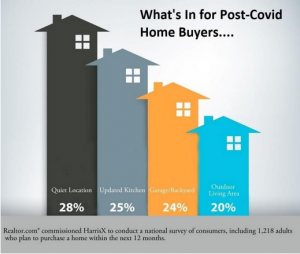

I am often asked by sellers what home projects should they address to get the highest return on investment. They are often surprised by my answer.

While most buyers focus on the standards of kitchens and bathrooms, research shows the best ROI is from replacing the garage door. A new door improves curb appeal, adds modern technology to the house and, based on my observations, doesn’t make as much noise as older models!

My information is based on an annual report from Hanley Wood, a D.C.-based real estate research and publishing firm. It produces an annual Cost vs. Value report to determine the national ROI for dozens of projects large and small.

Of the top 12 projects that garner the highest return, 11 are exterior projects. The lone outlier? The always-popular “minor kitchen remodel,” with 72% of the cost for such a job recovered.

A key takeaway from this year’s report is the impact that rising raw materials costs has had on home-improvement projects. Since 2014, prices have risen across the board for all the projects ranked in the report, but this year has seen a spike in prices. This has caused an average of -3% ROI for all home improvement projects.

Here are the top ROI projects for a typical home in the U.S. (Prices out West are generally higher):

——-

We have been reporting on the rising cost of lumber at your local DIY store. Prices soared as many Americans stocked up on wood for home remodeling and brand-new decks, all the while sawmills were struggling with production amid the pandemic.

That now appears to be behind us. Mills are back open in force and demand is easing as more consumers put down their hammer and nails in favor of post-pandemic fun and sun. The commodities market saw prices reach an all-time high of $1711 per thousand board feet in early May of this year after a pre-pandemic price of $303 (March 2020). The price has dropped to around $700 per thousand board feet (early July), however lumber retailers are still charging inflated prices for the goods purchased earlier in the year. It may take a couple more months before we see a price correction in your favorite hardware store.

HOUSING FOR ALL

The National Association of Realtors® (NAR) recently announced a new partnership with the LGBTQ+ Real Estate Alliance, a nonprofit that promotes homeownership and advocates for greater equality in housing. The LGBTQ+ community is estimated to hold $1 trillion (yes, with a T) in potential buying power in the housing market, but much of that spending opportunity has not been fully unlocked.

The National Association of Realtors® (NAR) recently announced a new partnership with the LGBTQ+ Real Estate Alliance, a nonprofit that promotes homeownership and advocates for greater equality in housing. The LGBTQ+ community is estimated to hold $1 trillion (yes, with a T) in potential buying power in the housing market, but much of that spending opportunity has not been fully unlocked.

NAR and the Alliance – to which I am a member of both – will partner to cultivate LGBTQ+ leaders and advocate for policies that support this growing segment of potential home buyers.

BY THE NUMBERS

>> Only 24% of Black households can afford a new home at the U.S. median price of $346,577, according to an analysis by the National Association of Home Builders. Hispanic households fare better with 32% of this segment being able to afford the mid-priced new home. Among non-Hispanic white households, 44% have sufficient income to qualify for a mortgage using standard underwriting criteria. Asian households claim the largest share at 56%.

>> The impact of a $1,000 price increase on a home varies among different racial/ethnic groups, but NAHB reported it is essentially proportional to population size. The largest priced-out number from a $1,000 price bump is 106,278 for white households, which account for about two-thirds of total U.S. households. Some 15,840 Black households and 21,376 Hispanic households would be priced out of the market from a $1,000 price hike on a home.

>> The Seattle metro area ended the first quarter with a 25% increase in single-family building permits over the previous year, along with a 101% increase in multifamily permits, the Master Builders Association of King and Snohomish Counties reported. For the first quarter of 2021, Pierce County led the way in single-family permit activity, with 1,173, reflecting a 61% increase of the previous year’s quarter. King County’s 855 single-family permits marked an 8% increase over Q1 of 2020, while Snohomish County’s 656 permits were just 5% above a year ago. For comparison, the three counties combined ended the 2020 calendar year with a 0.5% increase in single-family permits over 2019.

>> A whopping 3.8 million households secured home mortgages in Q1 of 2021, a 14-year high for one quarter, according to ATTOM Data Solutions. A majority of the loans, 68%, were mortgage refinances, up from 62% in Q4, as homeowners and buyers alike take advantage of low interest rates.

>> CoreLogic’s newly released Homeowner Equity Report for the first quarter of 2021 shows U.S. homeowners with mortgages (which account for roughly 62% of all properties) have seen their equity increase by 20% year over year, representing a collective equity gain of more than $1.9 trillion, and an average gain of $33,400 per borrower, since the first quarter of 2020. Flipping the coin, in the fourth quarter of 2020, 1.8 million homes, or 3.4% of all mortgaged properties, were in negative equity. This number decreased by 24%, or 450,000 properties, in the first quarter of 2021.

>> Vacation home sales are soaring across the U.S., according to a report from the NAR. They now account for 6.7% of all sales, up from 5.5% in 2020. We saw 310,000 vacation homes sold last year, a 16% increase year-on-year, and sales are up 57% so far in 2021. A full 53% of 2021 vacation-home sales have involved all cash. That compares to 22% of residential home sales that pay in cash. Leading vacation home destinations are in North Carolina and none of the top 10 are on our state.

>> Remember when house-flipping was all the rage? They made TV networks on the subject. Well, that storyline has flipped (sorry!). Only 32,526 single-family and condo homes in the U.S. were flipped in Q1, the lowest level since 2000, according to ATTOM. The main reason: profit margins have narrowed. ATTOM said the gross profit on the typical home flip (the difference between the median sales price and the median price paid by investors) declined in Q1 to $63,500, down from $71,000 in Q4 of last year.

JULY HOUSING UPDATE

The 2021 Seattle/King County housing market is like many others across the country, marked by rising prices amid a lack of supply and waves of buyers. It is truly the epitome of a sellers’ market and experts I hear from are saying, basically, get used to it.

“Home prices are going to continue to go up until the inventory comes back a bit,” said Rick Sharga, EVP at real estate information provider Realty Trac. “We’re going to hit an affordability wall at some point, even though we’re at record levels of prices. The combination of wages, generally speaking, going up at least among the home-buying cohort and interest rates being at historic lows has offset the extraordinary increase in home prices.”

Median prices continued their double-digit annual rise in June, according to the latest data from the Northwest MLS. The price of all home sales (single-family, townhome, condo) across King County for the month stood at $779,919, up 1.0% from May and 16% from 2020. While median prices of single-family homes across the county fell 1.1% month-to-month to $860,000, they were up 19% from June 2020. Single-family-home prices climbed 5.0% in the past month on the Eastside ($1.36M) and a whopping 40% year-on-year, including a 61% YoY jump in an area that includes Redmond and east.

The average home has sold this year $47,878 above the asking price (through May). More than 4500 homes in our area have sold for more than $100,000 over asking price this year, including more than 580 above $300,000, according to a report published in Seattle Agent Magazine. This time last year, only 362 homes in our area sold for between $100,000 and $300,000.

“That math doesn’t work forever, and interest rates simply don’t have further to go down at this point – not in a meaningful way,” Sharga noted. “At some point you hit an affordability wall and we may be seeing that in markets like Austin, like coastal California, like Seattle – a handful of markets where prices have probably gotten out ahead of what the buyers can really handle.”

Inventory across our area remains extremely low. It would take about two weeks – and as few as nine days on the Eastside – to sell all single-family homes currently on the market in the Puget Sound region if there were no additional listings to backfill the supply. Looking for selection? There is more than a month of condo inventory in Seattle, including two-plus months in Capitol Hill/Central District.

The one bright spot: King County saw more homes listed in June (4801) than in any month since May 2019, and the number of active listings by month’s end improved to a level not seen since last November – but supply is still below seasonal norms. For example, Southeast King County (Enumclaw, Maple Valley) led the rise in active listings among all home types as of July 1, up 31% month to month but down, coincidentally, 31% YoY.

In addition to King County’s 1.0% median price month-to-month increase on all home types, to $779,919, Kitsap County saw the sharpest jump – a rise of 3.6% from May ($505,000). Snohomish added 3.1% on its median price since May ($675,000) while Pierce climbed 1.5% MoM ($507,375). Single-family home prices in King fell 1.1% since May ($860,000), as the other counties rose for the month, led by Snohomish up 2.7% ($716,000), followed by Kitsap up 2.0% ($510,000) and Pierce up 1.2% ($516,000). Year-on-year, single-family median prices continued to soar, with Snohomish jumping by 32%, Pierce gaining 26%, Kitsap 22% and 19% for King.

Click here for the full monthly report.

CONDO NEWS

There is a renewed optimism across the downtown core of Seattle as small businesses and offices raise their window shades and flip the “Closed” signs. Yes, our city is coming back to life and welcoming workers, residents and visitors.

You can also see it in the increased sales activity at places like The Emerald, located within a block of Pike Place Market on Stewart Street. As of this writing, about 47% of the 262 units are under contract or sold – including this 36-floor, sub-penthouse with stunning West-facing views. That’s quite an accomplishment for a building that only opened in the final week of 2020.

One sales rep told me the “phone keeps ringing off the hook” from buyers and brokers scheduling tours of the 40-story, glass-and-steel structure. And what a building it is, as my walk-through tour of The Emerald shows. All the amenities – including the stunning top-floor indoor/outdoor lounge – are open.

Early buyers have scooped up 1-bedroom homes and the 1-bed with den, selling in the $540,000-$790,000 range, depending on the floor and views. More recently, buyers have taken interest in 2-bed homes starting around $930,000. Prices per sq. ft. range from $793 for city view homes to $2056 for the large penthouses with stunning westerly vistas. Call me if you would like to learn more; I am here for you!

——-

After a pandemic-related silence of several months, the sales team at First Light is back to making deals with interested buyers. If you will remember, First Light is Seattle’s future crown jewel of a condominium on the southern edge of Belltown at 3rd Avenue and Virginia Street (across from the old Bed, Bath and Beyond).

Construction is underway on the 48-story, 459-unit, ultra-luxe residence with about 70% of inventory presold (minimum 5% down at signing). Canadian developer Westbank is on point for the residential project, its third underway in the city.

All 1-bedroom homes are sold and only a few studios remain, starting in the mid-$600,000s. The remaining 2- and 3-bed suites range in size from 811 sq. ft. to 2333 sq. ft. and priced between the mid-$900,000s to $4.64 million for the last remaining penthouse on the 45th floor with expansive Southeast views.

Target opening is spring/summer 2023. Contact me today to learn more about the amazing amenities, including a one-of-a-kind outdoor pool.

——-

The Goodwin has opened its doors to prospective buyers in Belltown. Constructed for condo living more than a decade ago, the building originally opened as an apartment. Now fully converted, the 34-unit boutique condo on 1st Avenue and Bell Street is accepting contracts for occupancy as early as late summer.

We covered last month the shortages of materials for new home construction, prompting some developers to halt projects until prices dropped. Appliances are now the number one item in short supply. The Goodwin acknowledges it may not be able to provide owners with new appliances at move-in and will offer a credit if kitchens include older models.

I am planning a blog post real soon on this reinvented, 8-story option. The blog post will share more details on the homes as well as a look at the history of its Goodwin name.

——-

On the horizon, Shoresmith is expected to open its sales center this month. The opening was delayed about 8 months because of the pandemic. The eight-story, 113-unit condo is taking shape on Republican Avenue in the Cascade section (better known now as South Lake Union). What’s exciting about Shoresmith is that it’s targeting first-time buyers and anyone else seeking a less expensive option to Seattle living. Prices will start around $370K for a studio. Watch this space for more details!

LUXURY LIVING

We opened last month’s Luxury Living segment with a 3-bed, 3.25-bath, 4522 sq. ft., 31st-floor condo at Escala in downtown. The seller accepted an offer just before publishing this newsletter and I wanted to report that the home sold for $7M ($1548/sq. ft.), below the $7.2M asking price.

On to new listings, and we start far away. This 5-bed, 6.25-bath, 14,500 sq. ft., 2-story mansion sits on 21 acres of pristine land in Friday Harbor. (Every last word of that sentence raised the price by a million dollars each!) Seriously, this is one of the all-time priciest listings – $22.5M ($1452/sq. ft.). The property comprises two parcels … and about $35K in annual taxes! This may be one of the best listing videos I have ever seen. It makes you want to buy the place right now!

A true Snohomish County find: This 6-bed, 5.75-bath, 9955 sq. ft., historical, 3-story manse (with basement) on 2.8 acres is on the market for $3.5M ($352/sq. ft.). If these walls could talk, they would speak about the beginnings of the bayside community that would become Everett. The brothers Rucker – Wyatt and Bethel – helped found and develop the area in the early 20th century and this 1905 classic, red-brick Queen Anne/Italianate designed estate was their shared family home. A spectacular estate on a hill.

Seeking an unobstructed view of Elliott Bay looking West? We got that! The Fifteen Twenty-One Second Avenue condo is a classic luxury residential tower in the heart of Seattle. This 2-bed, 1.75-bath, 1824 sq. ft. 21st-floor home offers a perpetual Northwest view of city, sea and the snow-capped Olympics. Sellers are asking $2.9M ($1590/sq. ft.). Looking for something a little higher – How about this 35th-story, 2-bed, 2.25-bath, 2602 sq. ft. home with dramatic Northwest views for $5.25M ($2018/sq. ft.)?

Magnolia is one of the hidden gems in Seattle. Featuring hilltop views of water and mountains, it’s no wonder that so few luxury homes come on the market in this neighborhood. This 4-bed, 1.75-bath, 3000 sq. ft., 1-story with basement, mid-century modern home is a real catch. The property includes 50 feet of private waterfront along Salmon Bay, as this wonderfully produced video shows. Asking price: $2.79M ($930/sq. ft.). [Update: The listing is now Pending.]

For those with perhaps a more refined taste in homes, may I suggest this 4-bed, 2.75-bath (acccording to King County records, not the MLS listing), 4660 sq. ft., tri-level home in Queen Anne. There is incredible size in the rooms. (The owner, who has lived there about a quarter-century, reportedly said she hosted a party where 50 people gathered comfortably in the living room.) The home features expansive views of the city, Space Needle, Elliott Bay and Mt. Rainier on a clear day. List price: $4.8M ($1030/sq. ft.).

Evergreen Point is the small peninsula just north of the 520 Bridge on the Eastside and it’s the setting for dozens of super-lux homes. Why not join this slice of Medina? This 4-bed, 3.25-bath, 3718 sq. ft., 2-story with basement is a museum-quality beauty with recent updates to its 1964 bones. You’ll love the sliding walls that allow for different room configurations. It’s yours for $4.475M ($1204/sq. ft.)

And now, for a jaw-dropping listing that can become one of the highest-priced homes in our area this year (once it’s sold). We shared an 8360 sq. ft., 4-bed/3-bath home last year on Hunts Point that fetched $60M (you read right!). That is reportedly the record-high residential sales price in state history. (Another home there sold this year for $32M but details are scarce.) Well, just a handful of homes south, on the same West side of the point, we introduce a 4-bed, 4.25-bath, 4376 sq. ft., 2-story home (no basement) on one-third of an acre that is, yes, simply stunning! You’ll love the brick/Tudor home with chef’s kitchen, custom built-in cabinetry and infinity pool that offers views of your Lake Washington waterfront. Asking price (are you sitting down?): $28.5M ($6513/sq. ft.).

They say the two happiest moments for a boat owner is the day he/she gets the new toy and the day it’s sold. I wonder if that’s true for a houseboat? (Let’s not test that theory!) This 3-bed, 1.75-bath, 1750 sq. ft. floating home on the west side of Lake Union is on the market for $3M ($1714/sq. ft.). You will be surrounded by boats, neighbors and water. That sounds like fun!