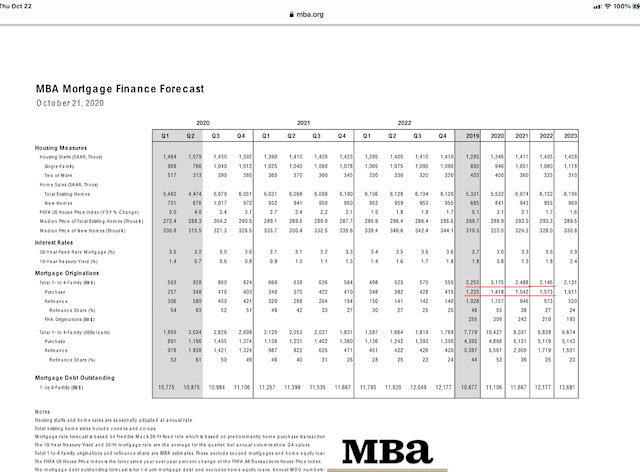

The MBA’s economic research team of Dr. Michael Fratantoni and his staff made national news at the MBA’s annual virtual convention, releasing a projection for 2020 of $3.18 trillion, the second-largest origination year in U.S. history next to 2003.

It’s worth looking inside the numbers though as we head toward year-end and think about 2021 strategies. Here are three key takeaways:

1. 2021 is expected to show refinance volume being cut nearly in half by just over $800bb, almost 50% of 2020. That trend is expected to continue in forward years in the MBA forecast. Why? Even a leveling of rates will result in refi coupon burnout as we complete the process of refinancing virtually everyone eligible.

Frankly, what will be left in the refi market will likely be harder credit quality transactions that a hungry mortgage origination industry will turn to as volumes drop. If rates rise modestly, as MBA suggests, we will be left with rates still near historic lows, a boon for homebuyers but still a contraction in refinances.

2. Despite this contraction, 2021 is forecasted to be a larger overall year than 2019 by approximately $195bb. So, while some right-sizing will occur, it will be to better levels than 2019.

3. The purchase/refi story here is important. Purchases in 2021 should be roughly $350bb larger than 2019, and $120bb bigger than 2020. Those that have a better purchase-to-refinance mix will be better prepared here.

So, what does this mean for originators?

Here are some expectations and recommendations:

First, the refi/purchase mix should be carefully evaluated down to the loan officer level. A top originator this year may become a challenge as the market shifts if they are heavily weighted in refinance. Run a spreadsheet by LO, branch and region. The analysis may expose training needs for respective production teams.

Doing this now will help lending teams establish a game plan to increase the skills of any refinance-focused LOs, as well as their managers. The skill needs of a proactive, outward-relationship building LO is much different than those of a rate-quoting refi originator.

Second, the second half of 2021 will be where the brunt of the slowdown occurs. This is because of two things. First, there is still plenty of “in the money” refis to be had, which should carry into the first quarter. Second, any slowdown of Fed MBS purchasing likely won’t start until a vaccine is in hand and the COVID trend line, and economic pathway, show distinct improvement.

This should mean that rates will stay at these lows for a few months, perhaps even dipping slightly lower through the winter. The good news is that this gives lead time for originators to train and prepare by doing the analytics of their sales teams and establishing a training strategy.

Third, the volume we have been seeing has also widened spreads as lenders used pricing to slow volume. As the market shrinks and capacity remains, it is almost a certainty that spreads/margins will contract due to competition, thus reducing loan-level profitability. The double whammy of a contraction, even small, is that it not only shrinks volume, it disproportionally shrinks profits as fixed costs remain high and pricing margins compress.

Conclusions? First, the mortgage market is always volatile, but the winners are the ones who “go where the puck is going”, to use the famous Gretzky line. In management, understanding “situational leadership” will help assess commitment versus competence challenges. Those leaders that plan in advance for this shift will be best prepared.

Second, there is no need to overreact. The good news is that this data provides clarity and preparation is key. In fact, if none of this happens, the best outcome will be the skills development of your teams, assuming you responded to this forecast in your own way.

And finally, there are great tools available that can augment a sales team’s abilities. There will still be refinance loans to be had and having skills to help borrowers capture equity in their homes in order to build wealth or reduce debt is a real value that can help many homeowners. But training and trainers must have content. The LOs will need tangible, implementable, skills versus hype and enthusiasm. Knowing the difference here will be the key.

Having been an LO and a manager in a very sales-focused and training-oriented company for the first part of my career was critical to helping me be ahead of the game in planning and preparation. Likewise, having good data from organizations like the MBA and others can provide you the information needed for success. The only question then is how mortgage leaders will implement an execution plan to be ahead of the change that’s coming.

This column does not necessarily reflect the opinion of HousingWire’s editorial department and its owners.

To contact the author of this story:

Dave Stevens at [email protected]

To contact the editor responsible for this story:

Sarah Wheeler at [email protected]