It’s safe to say we are tired of hearing the phrase “supply-chain disruption” and experiencing its effects. Trucking and warehousing jobs are going unfilled as consumers increase their love for online shopping, leaving many goods stuck at ports and in shipping containers within a disjointed distribution system.

There are signs of improvement. Analysts believe items that are now in shorter supply – major appliances, computer chips and specialty goods, to name a few – will return to shelves and front porches by the end of 2022 as the pandemic (hopefully) ebbs. One might argue, though, this is a symptom of a bigger ailment – America’s growing reliance on other countries for goods, a subject too complex (and off topic) for this newsletter to address.

One consumer segment will have longer to wait for its “supply chain” to be repaired – residential real estate.

“Of all the shortages afflicting the U.S. economy, the housing shortage might last the longest,” said a report from financial services giant Goldman Sachs. “While the supply of homes for sale has increased modestly since the spring, it remains well below pre-pandemic levels and the outlook offers no quick fixes for the shortage,” the report issued in October said.

Homebuilders face stiff headwinds to increase production. That includes shortages of land, labor and ladders (materials) – all helping to push up costs. The median price of a brand-new home is $407,700, according to October figures from the U.S. Census Bureau, an 18% jump from this time last year. (In last month’s newsletter, we covered restrictive zoning as another obstacle for builders.)

A modicum of relief is on the way. U.S. housing starts, when builders break ground and lay a foundation, are forecast to finish this year at 1.04M single-family homes, the first time since 2007 the figure will exceed a million. Economists forecast housing starts will rise a promising 5% in 2022.

Permitting, the step before breaking ground, is struggling to keep pace. Amid rising land and construction costs, permits for single-family homes in King County slowed in the third quarter to 940, down 7.8% from a year ago and at a level not seen since 2011. However, single-family permits for King and Pierce counties combined are up 4.2% year-on-year (YoY), according to U.S. Census data through October.

Who said this is a sellers’ market? Perhaps it’s truly a builders’ market.

Building developers are optimistic they can overcome many of the challenges. The National Association of Home Builders’ (NAHB) monthly sentiment index rose three points in November, to 83 on a scale of 1-100. (It was at 86 a year ago.)

“In addition to well-publicized concerns over building materials and the national supply chain, labor and building lot access are key constraints for housing supply,” said NAHB Chief Economist Robert Dietz. “Lot availability is at multi-decade lows and the construction industry currently has more than 330,000 open positions.”

The greatest challenge facing builders – and, frankly, the real estate sector as a whole – is finding and keeping skilled labor to assemble the sticks and bricks. The Home Builders Institute (HBI) described it at “crisis level” and predicts 2022 will be “more challenging” as other industries offer competitive wages and benefits to prospective hires.

Foreign-born workers make up about a quarter of the 7.5M construction jobs in the U.S., according to NAHB, but a sharp decline in immigration over the last decade – exacerbated by Covid restrictions – means the industry is short hundreds of thousands of workers.

HBI predicts the industry would need to add 740,000 workers per year to keep up with growing demand. In addition, workers are less likely to be self-employed now, gravitating to sectors that offer a full suite of benefits and greater income potential.

Ed Brady, CEO of HBI, says a long-term solution is to begin investing in education, nurturing new workers from an early age and encouraging more interest in construction trades. Says Brady: “One of our most important tasks as an industry is to work with parents, educators and students, as early as the middle-school years, to demonstrate that young people can have the promise of great jobs and careers in the trades.”

Brady warns: “This persistent challenge endangers the affordability and availability of housing and hinders a robust economic recovery.”

Locally, Seattle Central College’s Wood Technology Center, near Judkins Park, recently unveiled a certificate program in Residential Construction. As part of the one-year program, students can work for a local construction company during the day and attend classes at night. In addition to instruction on appropriate tools and materials for various contexts, the curriculum covers carpentry skills, stair building, interior and exterior finishing techniques, among other aspects of the job.

The median annual salary for residential construction jobs is $65,000, with more experienced workers earning upwards of $105,000, according to information from Seattle Central College.

The school indicated additional start dates for its new program may be offered if there is demand. People can learn more here or by contacting Rachael St. Clair via email or phone (206-934-5449).

GREATER BUYING POWER

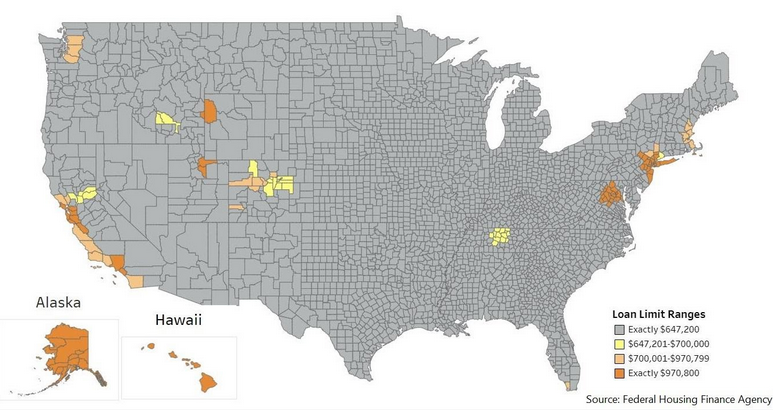

Buyers who are struggling to purchase a home in this frenzied housing market will receive a bit of a lifeline in 2022. The federal guarantors of most consumer mortgages have agreed to raise the borrowing limits on 30-year conforming loans.

Every year loan limits established for mortgage backers like Fannie Mae and Freddie Mac are reviewed and adjusted according to regional home values. Since prices in our area (and many others) have increased this year near or above double digits, the government has agreed to boost the loan limit by an-unheard-of 15% starting Jan. 1, to $891,250 in King, Pierce and Snohomish counties. Conventional limits will rise to $647,200 to finance similar, one-home properties across the rest of Washington.

This is incredibly beneficial for consumers. For example, a mortgage-approved buyer will be able to purchase a $938,000 single-family home (or possibly townhome or condo) with 5% down and keep within the new threshold. (The new loan limit on a four-unit, multi-family property will jump to $1.71M, which means a 30% down payment can possibly qualify a buyer for a government-backed loan of $2.45M at market rates.) Single-family-home buyers seeking to purchase a luxury home – known as a high-balance mortgage – will likely pay a higher interest rate.

You can see the 2022 loan limits for each county by clicking on this map:

In related news, buyers can now agree to have rental-payment history reviewed as part of their mortgage application. This is great news for consumers seeking to finance a home purchase, and the rental history will only be included in the underwriting review if the payments were consistently on-time.

Research by Fannie Mae showed about 17% of ineligible mortgage applicants this year would have qualified if rental payments were considered.

SCAM ALERT

While many moving companies are reputable, there are others that are out to take your shirt (and not return it without additional money). The Better Business Bureau (BBB) reports an increase in shady practices since the start of the pandemic, including demanding substantially higher fees after loading or transporting goods, having unreasonably long delivery windows and holding items hostage for additional charges.

The BBB said it receives about 13,000 moving-related complaints and negative reviews a year. The agency reminds consumers that it is illegal for movers to charge more than 110% of the estimate before delivery or to increase the price after goods are loaded.

How do you prevent being caught up in a suspected scam? The BBB suggests three steps when preparing to hire a mover:

- Get three in-person or virtual estimates based on weight, not cubic feet;

- Opt for full-value-replacement liability insurance;

- Check with the BBB and the professional moving associations (e.g., American Movers & Storage Association and the U.S. Federal Motor Carrier Safety Administration, which offers this handy checklist) about a company’s credentials.

Legitimate moving companies compete on price, professionalism and reliability – and they’re licensed. Most of them are members of trade associations that require adherence to professional standards.

BY THE NUMBERS

>> U.S. Census data found that 12.3M households were formed between 2012 and June 2021 but just 7M new single-family homes were built in that time. Realtor.com reports America is approximately 5.2M short of providing homes for purchase to those who want one.

>> Housing permits for single-family home construction in the Seattle/King County area this year is 49% lower than the peak period of 2002-2008. That’s according to John Burns Real Estate Consulting, which notes Chicago (-79%) and Miami (-76%) has the greatest declines in housing permits (data through June). Nationally, there is a 19% shortfall in permits compared with the peak period.

>> A survey of National Association of Realtors® members showed 34% of their clients were first-time buyers, up from 31% the previous year (July 2020-June 2021). The typical first-time buyer was 33 years old, while the repeat-buyer age rose to an all-time high of 56.

>> Sellers are probably celebrating, as the return on investment in their homes skyrockets. A Q3 report from ATTOM Data Solutions shows homeowners experienced a 48% ROI – the percent change between median purchase and resale prices – or an average gain of $100,178. Those figures are up significantly, from 35% and $69,000, respectively, in Q3 of 2020.

>> Owners are more “equity rich” than ever, according to a separate survey from ATTOM. A full 40% of U.S. homeowners have at least 50% equity in their homes, through Q3, up from 28% a year ago. The survey noted 56% of Washington owners are equity rich, the fourth-highest figure by state, with Idaho No. 1 (65%).

>> Migration data during the pandemic shows 15% of Washington residents moved out of state, with Texas as the No. 1 destination. The analysis from LendingTree also notes Washington was the top interstate destination for three neighbors – Oregon, Idaho and Montana. New York had the largest out-migration, 27%, and Texas the least, 6.7%, of all domestic movers between March 2020 and September 2021.

>> Survey data from Harvard’s Joint Center for Housing Studies forecast strong growth in home improvement and maintenance expenditures through 2022. The four-quarter trend projects $400B in expenditures by Q3 of next year or a gain of about 9% YoY from an active 2021. The center said “rapid expansion of owners’ equity is likely to fuel demand for more and larger remodeling projects” in 2022.

>> Bellevue and Redmond are tied as the region’s most expensive rental cities, with a median monthly layout of $2020 for a one-bedroom home. According to Zumper.com, Lynnwood, in third place ($1780 for a one-bed home), has the distinction of incurring the area’s largest YoY percentage price rise of 23%. Oak Harbor, meantime, is the most affordable city to live in our region, with one-bedroom rents priced at $1140/month. The median monthly rent across the state was $1425; Seattle rents will cost you a median $1760 (November data).

DECEMBER HOUSING UPDATE

Compared to most months, Seattle/King County buyers and sellers hit the snooze button in November, bringing a welcome – and likely temporary – break to the breathtaking pace of residential real estate sales.

This month’s headline: Inventory is at drought levels while median prices were little changed month to month.

There are about 60% fewer available homes on the market in King County than a year ago and 41% fewer from just October. That includes just less than 700 homes (single-family, condo and townhomes combined) for sale in all of Seattle and 133 available on the Eastside.

The cupboards are bare. Monthly inventory stands at 0.4 months (or 12 days) of supply if no new homes came on the market. This compares to 0.6 months’ supply in October. Inventory in Seattle and the Eastside are also at incredible lows, 0.7 months (vs. 0.9 in October) and 0.2 (vs. 0.3), respectively.

Prices kept in a narrow range between October and November. The median price of all homes sold in King County stood at $740,000, down 1.3% from October but up 8.0% from a year ago. Median Seattle prices were down 3.2% in the past month to $765,000 but 1.0% higher YoY. Eastside housing prices continued to climb, up 6.6% over one month and 26% YoY to $1.2M.

We shouldn’t be surprised by stagnant prices and fewer listings during this time of year, but the decline in homes for sale is alarming. Within the single-family-home sector, there were 46% fewer listings on the market than just a month ago, including 58% fewer in North King County. There were 58% fewer single-family listings in the county YoY, led by declines of 68% on the Eastside and 63% in Seattle.

Single-family prices were stable – officially down 1.0% across the county ($820,000), flat in Seattle ($850,000) and up 4.6% on the Eastside ($1.43M) since October. They have gained 12% in King for the year, including 35% higher on the Eastside and 3.7% in Seattle.

Condo prices were a mixed bag. While they were down 3.1% ($460,000) month-to-month in the county, prices were off a full 21% since October in North King ($397,000) while up 8.9% in Capitol Hill/Central District ($527,500). Seattle condo prices declined 4.6% in the last month to $500,999, while Eastside prices added 1.0% to $555,500. Prices were up 2.5% in the county over the past year.

Of the 30 submarkets within King County tracked by the Northwest Multiple Listing Service, Mercer Island has the most expensive median price of $2.21M for all home types. Des Moines and Auburn share the distinction of having the most affordable pricing at $510,000 (November data).

In addition to King County’s 1.3% median price decline month-to-month for all homes sold, to $740,000, all three neighboring counties – Snohomish ($658,505), Pierce ($505,000) and Kitsap ($500,000) – experienced a 1.0% drop. Prices for single-family homes (which include townhomes) in Kitsap County declined the most, off 1.6% ($500,000), in the past month. That was followed by 1.0% drops in King ($820,000) and Pierce ($515,000), while prices in Snohomish were unchanged ($695,000). Over the past 12 months, single-family median prices rose 23% in Snohomish, 16% in Pierce and 12% each in Kitsap and King counties.

What may 2022 offer for our housing market? John L. Scott CEO Lennox Scott told Seattle Agent Magazine: “In 2022, I anticipate we will see positive price appreciation although it will be a bit more mellow than it has been over the last several years. I expect home prices will follow typical seasonal patterns in the year ahead.”

Click here for the full monthly report.

CONDO NEWS

Another year in the Seattle/King County condo market is all but written with a lot to show for it. Three projects opened their doors in recent months – the magnificent Spire, the cultural stalwart KODA and apartment-conversion The Goodwin – helping to support a market rebound since the city “shutdown” of 2020.

Northwest MLS data show pending condo resales jumped 73% YoY (through November) in Seattle, including up a whopping 131% in downtown. New construction properties experienced a surge in demand as well, with pending sales up 107% in Seattle, and 78% in downtown since this time in 2020. The result: condos stayed on the market for a median 14 days (down 13% from a year ago) and 18 days in downtown (down 25%). Sales volume in dollar terms jumped 40% in Seattle YoY and 54% in downtown.

———-

Speaking of Spire, project representatives shared they are setting sales records and are now about half sold of their 343 luxury units. The sales team says Spire is currently the second-highest-selling residential building on the West Coast. Homes are priced from the high $400,000s. Doors opened in August in a high-rise that features an innovative (and Seattle first-of-its-kind) garage parking system.

———-

Unfortunately, the number of new Seattle condo options in the pipeline is easing. There are two prime choices:

The Graystone, a 271-unit, luxury high-rise is next. It is planning to open in Q1 2023 at 800 Columbia Street on First Hill.

The city is also anticipating the 2023 unveiling of First Light. The 459-unit, ultra-luxury condo recently completed shoring up its multi-level, below-ground parking facility at 3rd Avenue and Virginia Street and is ready to embark upon pouring concrete up, up and up to 48 stories. The high-profile high-rise is more than 70% presold.

———-

With exploding construction costs, developers are either holding back on grand projects until economic seas calm or focusing on the immediate rental generator of apartment construction.

Two recently completed condominium developments – Shoresmith in South Lake Union (reported in our September newsletter) and Encore in Columbia City – reverted to apartments soon before opening. Officially known as Encore at Columbia Station, the 96-unit project apparently struggled to bring in enough purchase commitments and prompted developers last month to welcome immediate rent revenue instead.

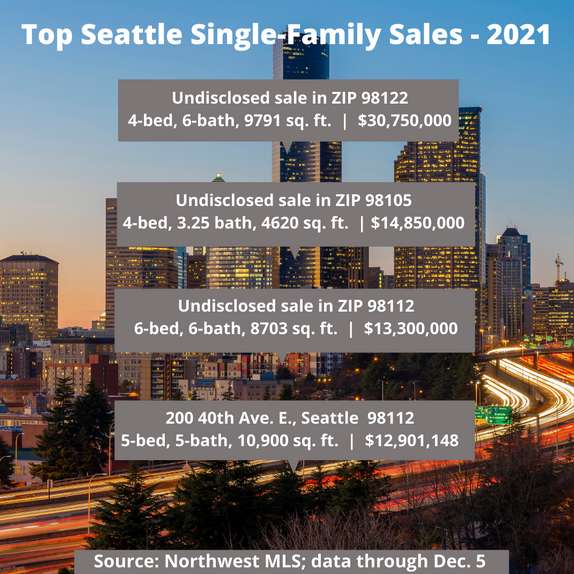

LUXURY LIVING

This corner of the newsletter is a little quiet this month, as you might expect. December is typically the sleepiest time in real estate – especially for luxury sales.

One property – on the market for about 40 days (and 40 nights) – is awesome in size and living standards. It’s a 6-bedroom, 5.5-bath, 6363 sq. ft., 2-story equestrian property on 26+ acres in Novelty Hill/Redmond. The gated entry opens to an authentic European cobblestone drive that takes you to a home that evokes Tuscany and Pacific Northwest. Amid the five fireplaces, two kitchens, sauna and sport court, residents can enjoy walls of windows with French doors that open to beautiful vistas of the Cascades. Naturally, the property wouldn’t be “equestrian” without a barn, tack room and covered walking pen for your stallions and mares. The owners, who wish to remain anonymous, include the managing director and partner of a wealth-management firm. They purchased the home in 2016 for $2.165M and are asking $4.75M ($747/sq. ft.).

One other home that we liked this month is a 6-bedroom, 3.5-bath, 5108 sq. ft., 1-story home with finished basement in Medina. The skylighting and massive kitchen made this one of my favorite listings of the year. One downside: The property is located within earshot of the SR-520 bridge. I would say a buyer could ask for a “noise” discount when negotiating price but, sadly, the home went Pending Inspection within 16 days on the market. The sellers were seeking $7.8M ($1527/sq. ft.) and the home should complete its transaction in about a month … unless the inspection fails. So, yes, I’m saying there’s still a chance to make a back-up offer!