Forecasting the direction of the economy and residential real estate is never easy, particularly in a pandemic and following a mini-recession. Our annual forecast from late 2020 offered a bit more optimism than reality but it hasn’t stopped us from producing another look at what the year ahead may offer.

Welcome to the fourth annual Living the Dream blog predictions and projections in real estate and beyond.

What did we see in 2021? Seattle/King County homeowners that were on the ball likely timed their sales at one of the highest temperatures of market hotness in recent years. They took advantage of multiple bids, price surges, waived contingencies and all-cash offers.

At the same time, many others found themselves reluctant to market their homes amid fear of not having a clear replacement strategy. A shortage of homes for sale sparked some of the fastest-moving deals in memory, particularly on the Eastside, where single-family homes “sat” on the market for a median 5.4 days (November 2021).

==========

What will the 2022 Seattle/King County housing market offer? Here are three consensus predictions:

Interest rates will rise as much as a full percentage point by the end of 2022.

Buyers will continue to outstrip sellers by a significant margin but less extreme than in 2021.

Home prices will climb at a slower rate than in recent years.

==========

There is a general expectation that more households will place their home on the market in the coming months. Realtor.com surveyed 1300 homeowners and found 26% plan to sell their place in the next 12 months (as of autumn 2021). Millennial owners led the way in the survey, with 49% planning to sell. A majority of those said their home no longer meets their needs – space, features, location – and they want to take advantage of favorable mortgage rates.

Buyers are seeing rates inch higher – currently at about 3.25% in Seattle/King County for a typical 30-year mortgage (rates vary based on an applicant’s circumstances). A year ago, interest rates were forecast to end 2021 at around 3.1% nationally and that is exactly where they stood as of Dec. 2 (Freddie Mac).

Rising rates will add to mounting affordability concerns that are affecting our market and starting to force some buyers to the sidelines while price growth slows. Since this time last year, rising rates have pushed the average mortgage payment up $160 a month but, historically, the cost of financing is quite low. (How do 8.0% mortgage rates sound? That was the average national figure in 2000.)

The appetite for seeking a mortgage has declined slightly, down 2% from Q2 to Q3, a possible sign that the market boom is finally cooling after a red-hot run since pandemic-related constraints were lifted in mid-2020. Mortgage applications are an early sign of buyer demand, which has been sharply higher in recent years amid lower rates.

Meantime, the number of foreclosures will likely increase after a lengthy moratorium during the pandemic. Forbearance programs have essentially ceased, forcing homeowners unable to continue their monthly payments to either sell or go into foreclosure. With such a shortage of homes on the market, owners should have no difficulty selling.

By the Numbers

Seattle/King County, while navigating severe challenges, is rebounding economically and was recently recognized by a national survey of real estate experts as an emerging region to watch in 2022, with our county the only West Coast market in the top 10. Economists forecast 7.5% annual growth for King in 2022 (through next August) after 2.7% growth the previous 12 months.

We are not immune to inflationary pressures, which can be noted today at the gas pump and on store shelves. Consumer prices are going up and up – 6.5% higher in October (year-on-year) in Seattle/Bellevue/Tacoma. That’s far higher than YoY figures at the end of 2020 (up 1.7%) or 2019 (2.5%). Prices in King County are expected to end the year up 4.2% and are forecast to climb a more modest 2.9% for the 12 months ending next August (latest available forecast). Nationally, consumer prices rose 6.8% in November to the highest level since 1982.

Gasoline prices in the Seattle area averaged $4.58 a gallon (official data, Nov. 29) and, unofficially, $4.44 a gallon as of Dec. 7. One recent analysis indicates prices could rise well above $5 a gallon at the pump by this time next year if OPEC nations continue to struggle with logistics and capital to explore crude oil.

Inflation in Seattle/King County increased a sharp 4.1% for the period ending September (figures are released quarterly), driven by higher energy costs, food prices and rent. (It rose 2.4% last year.) Even while inflation is rocketing nationally – up a troubling 6.2% in October, the highest rate since 1990 – it is expected to rise by only 2.8% in 2022 in King County.

Barring any unforeseen setbacks with the pandemic, energy prices or involving U.S. relations with China or Russia, the current path of inflation will not upend real estate activity, according to economists, as Gross Domestic Product is forecast to run 4.9% this year nationally and 3.8% for 2022. There are too many consumers searching for homes and clearly not enough inventory, however that still means costs around goods, services and housing are going to inflate.

The latest economic data also corresponds with a rise of the Delta variant, which necessitated a pullback with some office reopenings. A significant 77% of eligible King County residents are fully vaccinated against Covid-19 (and 85% have at least one dose), which should help keep the region in a favorable position even while confronting the new Omicron variant. However, only 29% of office workers have returned to the core of Seattle, compared with figures from 2019, according to the Downtown Seattle Association.

Job levels in King have rebounded by 6.1% YoY through Q3, but they are still down about 30,000 positions relative to pre-Covid. The county lost nearly 150,000 jobs in April 2020 alone. Most of the remaining positions that have not returned are in high-contact industries like leisure and hospitality that should come back as these sectors recover.

Economists forecast a continued, but slow, return to pre-pandemic employment figures, with a rise of 4.2% more people to the region’s workforce in 2022. In addition to leisure and hospitality jobs, more workers are finding employment with tech companies – Amazon, Facebook, Microsoft and Google – particularly in Bellevue, Redmond and Kirkland, where the current wave of commercial construction is a precursor to an even greater demand for housing.

The county unemployment rate stood at 4.4% (October), well below the year-end forecast of 5.1% established at the start of 2021. The City of Seattle enjoyed a jobless rate of only 3.8% (October). U.S. unemployment was 4.2% (November), inching closer to the 3.5% figure that prevailed before the pandemic, a 50-year low.

The Infrastructure Bill will also provide an economic boost with more than $8.5B headed to our state to address highways, bridges, public transit, electric vehicle chargers, high-speed internet and clean drinking water. The projects will take years to complete and likely add thousands more jobs.

Meantime, analysts believe local population growth should continue but at a reduced 1.2%-1.4% range with around 30,000 additional people living in King County in each of 2021 and 2022. The county grew by 32,500 for the year ending April 2021, which is close to the average annual growth over the 2010s. The county’s population is about 2.3 million. Seattle’s population grew 1.1% in the past year to about 740,000 (Note: Revised from 770,000). Bellevue, the county’s second-largest city, grew by 1.2% to roughly 150,000.

Interestingly, King County economists see an increase in personal income in 2022 of only 0.4% after a 7.1% expected surge this year. This should add further pressure on buyers to meet the local housing-price demands.

County residents earn a median $109,000 (2020 data), about a 6.4% rise from a year earlier. The rise in personal income continues to fall further behind the rate of home-price increases, which, according to the Northwest Multiple Listing Service, have climbed 50% in just five years for all home types and 156% – well more than doubled – since November 2011 ($292,500).

New construction across King is projected to decline a surprising 11% in dollar terms in 2022. That’s after a drop of 3.8% in the 12 months ending in August 2021 and it follows strong double-digit activity 2014-2019.

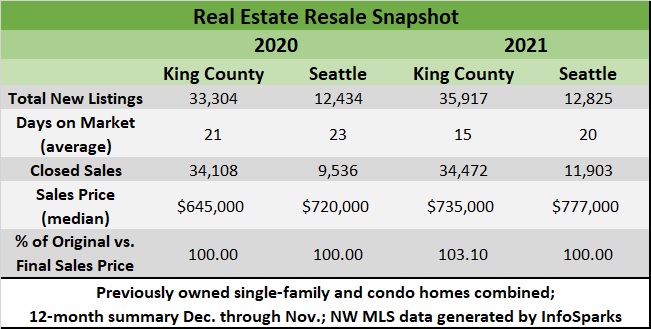

Prices of existing homes continued their unprecedented climb in 2021. The Case Shiller index showed prices through September added 23% in the region that includes King, Snohomish and Pierce counties. (Case Shiller data is two months behind sales info from the NW MLS.) The MLS reported prices for all home types in King County gained 8.0% to $740,000 from this time last year ($685,000), powered by record-setting growth on the Eastside, where median prices gained 26% YoY to $1.2M. Prices are sharply higher in Snohomish (22%), Pierce (16%) and Kitsap (14%) counties (YoY through November).

The housing forecast should be more palatable for buyers. Nationally, the Mortgage Bankers Association sees a slow, steady cooling – from a 16% increase in prices by the end of 2021 to a 5.1% forecast gain 12 months from now. (Even in the housing bubble of 2005, prices rose “only” 12% nationally.) Mortgage purchaser Freddie Mac forecasts 17% YoY price growth by the end of 2021 and 7% appreciation for the year ending next December. A more conservative NAR says home prices will experience 2.8% price growth in 2022 after an expected 15% rise this year. And a survey of 40 housing analysts conducted by Reuters estimates prices will gain 5.6% nationally over the next year.

“With more housing inventory to hit the market, the intense multiple offers will start to ease,” predicts Lawrence Yun, chief economist with NAR. “Home prices will continue to rise but at a slower pace.”

In the more desirable real estate markets – such as in the Puget Sound region – housing prices will continue strong appreciation. Average price growth in King County is historically around 5% for all home types, a level more anticipated in 2022, with economists at realtor.com forecasting 7.5% price growth in King and Pierce counties combined. Single-family home prices will continue to drive appreciation, likely in the 8%-10% range. Eastside and South King County should continue their double-digit price growth.

“Whether the pandemic delayed plans or created new opportunities to make a move, Americans are poised for a whirlwind year of home-buying in 2022,” predicts realtor.com Chief Economist Danielle Hale, who forecast a 9.6% increase in home sales in the King/Pierce county region for 2022. “With more sellers expected to enter the market as buyer competition remains fierce, we anticipate strong home sales growth at a more sustainable pace than in 2021.”

———-

National research claims that Americans moved less often in 2021 than in the previous two years. Some analysts opine that households considering a move have waited for clarity from their employees on work-from-home rules while a recent poll showed that 48% of employees will likely work remotely at least part of the time after Covid. Clearly, the increased number of remote workers could have a significant impact on jobs, residential real estate activity and office leases.

In addition, the challenges of getting on the property ladder in our region and obtaining a bigger home are prompting people to move further from urban centers and commute less to the office (if at all). Many – particularly first-time buyers – will choose distance and more affordable homes than being closer to the office and possibly throwing money away in rent.

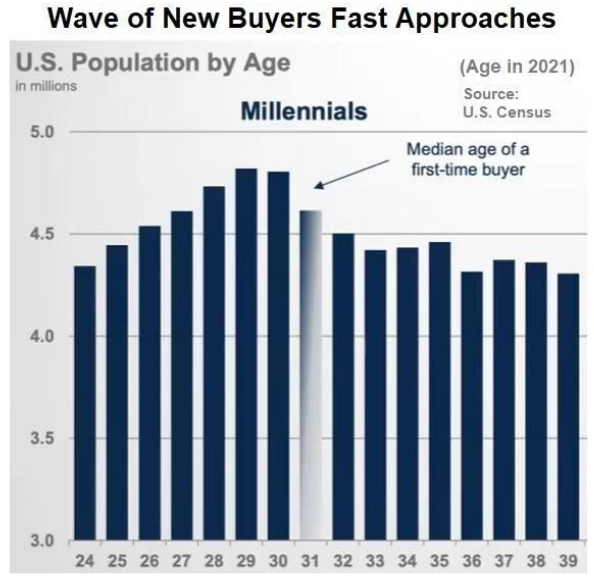

Meantime, one local finance expert said this fall he believes “we are on the crest of a historic real estate boom” in King County. He suggested the emergence of Millennials as a group of buyers and tech industry growth – particularly on the Eastside – has our region “ready to pop.”

Millennials, all 45M of them nationally, are the largest generation in our history and, now that most are in their 30s, are expected to power the Seattle/King County housing market for at least the next decade. They account for about 528,000 of our approximate 3.3 million population (Seattle-Bellevue-Everett; U.S. Census) and are starting families with a desire for more space.

“For years, we heard about the dying suburbs because Millennials didn’t want to live there,” says Hale, quoted by realtor.com. “But as they age, guess where they’re heading?”

Those born in the 1990s – young Millennials and older Gen Z – are the next-largest group seeking housing. They comprise about 468,000 people in King and Snohomish counties and are likely to focus on urban residences such as condos, townhomes and, if renting, apartments.

“I know a lot of people are expecting housing prices and sales to peak and then decline,” Hale notes. “Instead, I think there’s enough momentum from these younger buyers who want to get into the housing market to keep sales moving forward.”

———-

Permitting of single-family homes in King County will not help the housing shortage anytime soon, as building permits slowed in the third quarter to 940, down 7.8% from the same time in 2020 and a low not seen since 2011. Multi-family permitting in King, however, surged 38% YoY (3925 units). Single-family permits for King and Pierce counties combined rose 4.2% (7636) through October.

There will be greater attention to zoning – a topic we covered in detail in the Living the Dream newsletter. As demand continues to outstrip supply, King County and state lawmakers are being urged to look toward Oregon and California, where zoning regulations have been essentially erased. (Seventy percent of Seattle is residential zoned land for single-family homes, severely limiting options for greater density.)

The creation of additional Link light rail lines north, east and south should bolster multi-family construction but many of those properties are apartments. Builders focus on projects that typically generate the greatest payoff at the quickest pace to overcome strong headwinds, including labor and materials shortages. The number of open construction positions nationally varies between 330,000 and 430,000, and the country will need thousands more of these skilled workers every month going forward.

“We need to place 740,000 people into the industry a year for the next three years,” Ed Brady, the CEO of Home Builders Institute, told CBS News earlier this month. “That’s at crisis levels. I don’t know how we’re going to catch up.”

Economists at realtor.com predict the number of homes for sale will inch up only 0.3% in 2022. Single-family housing starts, when builders create the home’s foundation, is expected to rise 5% next year nationally.

Seattle Development

One of this region’s biggest and brightest infrastructure projects is less than a year away from opening. The Washington State Convention Center addition – also known as the Summit building, in downtown Seattle – is expected to be unveiled next summer. That opening will be joined by a mid-2022 reopening of the West Seattle Bridge, which has been closed since March 2020 amid concerns over its structural integrity. The resumption of bridge traffic will be a welcome sight for residents and real estate buyers in that section of the city.

Also, construction is expected to begin in early 2022 on Overlook Walk, an elevated pedestrian connection between Pike Place Market and the Seattle Aquarium. This is part of ongoing waterfront improvements (a topic previously covered) that are scheduled to be completed in 2024.

The new year will be a rather quiet one on the condo construction front. After three significant openings in 2021 – Spire, KODA and The Goodwin – there are plans for only one new unveiling in ‘22. Infinity Shore Club Residences (below), a 37-unit beachfront condo, comes to Alki Point in West Seattle with a target opening of late March.

Prices range from $1.12M to about $5M for residences from approximately 1160 sq. ft. (1-bedroom with den) to 2400 sq. ft. (3-bedroom with den). Nine of the homes are under contract, as of this writing.

It may be several years before another wave of condo development hits Seattle and catches up with demand. That should put greater interest on the next major project – the 271-unit Graystone on First Hill – attracting a lot of attention before its opening in about 15 months. (The 48-story condo First Light is tentatively set to open later in 2023 in Belltown but the project is only on the first floor.) On the Eastside, 2023 will include both the arrival of the Link light rail and the planned opening of Avenue Bellevue, with its twin-tower community comprised of luxury and ultra-lux condos, specialty retail shops and five-star hotel.

Analysts predict 2022 will be marked by a continued return of residents to dense urban housing, meaning existing condos and apartments vacated during the pandemic will be reaching capacity. In fact, condo sales in Belltown/downtown Seattle rose 67% YoY (through November). However, sales of resale inventory fell 23% YoY on the Eastside amid a sharp drop in available listings.

What advances are real estate customers seeing?

The development of seller-friendly, bridge-loan solutions is a game-changer. Until recently, buying a new home before selling the existing property was a significant roadblock for many consumers. Financial institutions now provide so-called bridge solutions to help empower buyers before selling their homes. John L. Scott Real Estate has partnered with Priority Home Lending to develop several loan options that bridge the gap between buying and selling.

As you no doubt know, the advances in mobile communications have been startling. We have come so far in a couple of decades. Now 5G is all the rage and the real estate industry could not be more excited to put it in action. The speed – about 100 times faster than 4G – will improve user experiences when participating in video walk-throughs of a home or with AR (augmented reality) tours.

It’s safe to say that Americans are ready for greater autonomy and automation in their daily lives and real estate will be right there with them. Thanks to 5G, the process of buying and selling a home will be more streamlined and secure.

John L. Scott CEO Lennox Scott said he is always thinking about how to improve the client experience. How?

“First, reduce the transaction process time,” Scott says. “We’ve got it down now to 10 days, but we want to get it down to five. That would free up the agent and provide more certainty to buyers and sellers.

“Second, assist the ‘residential investor’ nation by ensuring that every listing can be seen nationally in a nano-second. Third, provide a portal to give each property owner easy access to all the information on their property,” Scott says.

He adds: “One of the responsibilities of leading brokerages is to identify these kinds of issues before they become issues and develop practical and doable solutions to address them. This is our approach that keeps our company proactive and passionate in a world where needs have been ever-changing since my grandfather came to town [Seattle] 90 years ago.”