As a wave of new jobs approaches the Eastside, where are they going to live? For many, it won’t be within close distance of the area’s booming office expansion.

The job numbers are staggering. Amazon alone is promising to fill 25,000 positions east of Lake Washington in the next few years. Fellow tech giants Google, Meta (formerly Facebook) and Microsoft are bulking up as well. Overall, some 40,000 new positions are earmarked for the Eastside in the coming years.

Amazon, which currently employs about 80,000 people in our state, has added or is building more than 6.6 million sq. ft. of space in downtown Bellevue alone. That is said to exceed the total commercial area for the downtown core from 20 years ago – by 1.6 million sq. ft. And just to the East in the Spring District, Meta has committed to a total of 1.8 million sq. ft., just as Google opens another office building in Kirkland and Microsoft expands its 120-structure Redmond campus with 17 new office buildings.

All this tech construction gives new meaning to IT architecture!

“A growing diversified base of technology companies continue to proclaim the Eastside market as one of the best living and job opportunities in the country,” noted local commercial property firm Broderick Group in a report issued last month.

Taking a closer look at Bellevue (pictured above), about 350 for-purchase condo homes have been delivered in the last 18 months. Another 1350 are under construction with delivery in the next two years, including the high-end Avenue Bellevue. The project pipeline is quite promising too, with at least 7500 residences – mostly apartment units – likely to be added in the next five years between downtown and the Spring District.

In addition, the City of Bellevue is creating opportunities to live where people work or near transit hubs while also expanding pedestrian and bike networks. It has also set its sights on rezoning portions of the city to increase housing density.

While these are promising developments, there will always be the affordability question. Between 2011 and 2019, the median household income in our area increased by about 34% but housing prices jumped 78%. The median sales price of a single-family home today on the Eastside is $1.72M, up 33% from a year ago while condo prices have risen 30% to $674K.

The math does not work for most of us and there is little notion of a drop in home prices on the horizon. Elementary school teachers in Bellevue have a median annual income of about $78K, which falls well short of what one can afford for a starter home. Of the 7850 downtown Bellevue area residences noted above, only 78 – 1% – are known to be allocated to lower-income households.

Local leaders and big tech are moving to bring forward more affordable housing but that takes planning. Bellevue is rolling out plans for 235 affordable housing units in Wilburton for households earning 50%-80% of the prevailing median income for the county (which translates to $57,850-$92,560 for a family of four or $40,500-$64,790 for someone single). While laudable, that is a drop in the proverbial housing bucket.

“We’re not just talking about high-wage earners,” Bellevue Mayor Lynn Robinson told Puget Sound Business Journal in January. “We’re furiously building apartments and condos and townhouses and single-family homes as best we can.”

Microsoft has committed $750M since 2019 to help support the creation of more affordable homes in Seattle metro. Amazon has invested more than $1.2B to create or preserve more than 8000 affordable homes for low-income families within a 10-minute walk of a transit center. The e-commerce/web services giant recently announced a partnership with housing advocates to buy three Bellevue buildings with a total of 470 apartments.

The private-public initiatives aim to expedite redevelopment by reducing obstacles to financing urgently needed housing. The result will create more workforce housing for people who are typically outside the high-wage-earning tech sector – including teachers and first reponders – and wishing to be near their Eastside jobs.

Commuting by car with high gas costs can be prohibitive. (And have you ever driven on I-405 during rush hour?!) Thankfully, the 2024 planned opening of Link light rail’s East Link Extension to Bellevue and Redmond will present a viable option if living on the other side of Lake Washington.

There is great promise and tremendous potential as a live-and-work environment for Bellevue and surrounding towns and cities. Let’s just hope government leaders and other influencers remember to bring everyone along for the ride.

DID SOMEBODY SAY, ‘HOUSING BUBBLE?’

Are we in a housing bubble? Some of the experts are cracking open the door to that possibility.

“The housing market has become bubbly,” said economist Enrique Martinez-Garcia of the Federal Reserve Bank of Dallas. He was one of the authors of a recent report that found signs of a housing bubble in the real estate market. “This looks a lot like the housing boom that we saw prior to the 2007–09 financial crisis.”

The national numbers are starting to be concerning. That’s where buyers are paying about 42% more in their monthly mortgage payments for the same house today than they did a year ago. The potent combo of rising U.S. home prices, up 14% year over year (YoY) by one measure, and escalating mortgage rates, which have risen about 2.1 percentage points so far in 2022, has added several hundreds of dollars a month for new buyers’ mortgage payments.

Black Knight, a mortgage technology and data provider, claims Americans are now expected to spend 31% of their monthly income to make a mortgage payment on the average-priced U.S. home (about $400,000 vs. $971,000 in King County). That percentage was last seen in September 2007 – yes, at the start of the housing crisis (as the chart shows).

Let’s be clear: The major reason for the housing crash some 15 years ago was a huge number of foreclosures. With much stricter mortgage standards and a historic level of homeowner equity today, the fear of massive foreclosures impacting the U.S. housing market is unrealistic.

Sidenote: Adjustable-rate mortgages (ARMs), which typically have lower interest rates than fixed-rate mortgages, have become an attractive option for new buyers financing a home. The spread between a 30-year and ARMs – in which rates can be adjusted typically after 5 or 7 years – is the widest since 2014. Talk to your lender to learn more.

How can the system handle skyrocketing home prices, mortgage rates and rental prices simultaneously? Some believe it can’t.

“We’re not in a housing bubble just yet — but we’re skating close to one if prices continue rising at the current pace,” noted George Ratiu, manager of economic research at Realtor.com®.

But, “wait!”, I can hear you: “Will, you said last June that we would not see a housing bubble!” True, and I stand by that statement all these months later for our market.

You would be hard-pressed to find economists proclaiming that today’s housing environment in the PNW is nearing anything close to the 2008-type bust. Plus, the average American owners have 45% equity in their home today, far stronger than back then. So, let’s take that question off the table for now.

Our region is a golden unicorn. We live in a young, vibrant area, buoyed by exponential economic growth and amazing expansion. (Did you read the story above?)

Add in an unprecedented wave of Millennial first-time homebuyers, many enjoying elevated wage growth in a market with limited supply, and you have all the makings for a resilient housing market for years to come. Don’t be surprised if home prices continue to rise into the summer before there is a cool-off.

Real estate data firm CoreLogic puts housing markets into one of five categories based on the likelihood that home prices will fall over the coming 12 months. They range from “Elevated” (over a 40% chance of a price drop) to “Very Low” (0%-10% chance). CoreLogic puts Seattle-Tacoma at “Low” (10%-20% chance), though Kitsap County is a “Medium” risk.

No crash. Probably not even a correction. Yes, pockets of King County may experience new home listings lasting for weeks rather than days, fewer offers on homes, bids at or even below the asking price and more of them with contingencies for home inspections and other conditions.

That’s welcome – a civilized housing market rather than one that has been bonkers for a few years.

One market analyst described the situation as like “air escaping an over-pressurized tire through a very small puncture. The tire is not going flat quickly, but it will get slowly softer.”

Now, breathe easier … and don’t read too much into those national forecasts. King County is in a far more resilient position than many parts of the country.

BY THE NUMBERS

>> The average size of a newly constructed single-family home is now 2524 sq. ft., according to research from the National Association of Home Builders. That’s up from 2333 sq. ft., based on 2020 data from the U.S. Census. Millennials and Gen Xers are driving the demand for bigger homes, with both noting the pandemic changed their housing preferences.

>> Insights from 12,000 consumers and over 300 architectural designers show that 51% of residents will work from home in 2022, up from 33% before the pandemic. The research from John Burns Real Estate Consulting also noted 38% of respondents will have a hybrid working schedule and 13% will work full-time at home.

>> The Puget Sound region suffered from a severe lack of new construction in the decade ending in 2020, according to U.S. Census data and reports from Washington’s Office of Financial Management. Kitsap County had the fewest number of units built per household formed between 2010 and 2020 (0.55). Pierce County was at 0.81, while Snohomish (0.85) and King (0.91) were slightly better.

>> Neilsen research shows that 11.5% of adults in the Seattle metro area – or 365,000 residents – plan to move within the next 12 months. That’s down from 12.9% two years earlier. The latest survey took place June 2020-October 2021 and asked 2700 adults in King, Pierce and Snohomish counties.

>> In a survey of about a thousand professionals working full-time from home, half said they would look for a new job with remote options if their current employer required a return to the office full-time. The figure is 16 percentage points higher than a year ago, according to the survey from business/talent consulting firm Robert Half. Working parents (55%) and Millennial professionals (65%) are most likely to quit if called into the office full-time.

>> The percentage of homes flipped jumped 26% in 2021 from the year before, according to ATTOM Data Solutions. The 323,465 flipped single-family, condo and townhomes is the highest number since 2006 and represented 5.5% of all home sales last year. Homes flipped in 2021 generated an average gross profit of $65K, down from $67K the year before and the lowest margin since 2008.

>> Median single-family home prices in the first quarter of 2022 rose at least 10% from one year ago in 63% of all U.S. counties, according to a report from ATTOM. The report also found that 26% of the average American wage is needed to buy a typical single-family home in the U.S., the highest percentage since Q3 of 2008. That was within the 28% ceiling considered affordable by common lending standards.

MAY HOUSING UPDATE

Headline writers will latch on to one figure from the latest market report from the Northwest Multiple Listing Service (MLS) – $1,019,950. That is the latest median sales price in Seattle for a single-family home – the first time in the city’s 157 years of incorporation that the median figure has surpassed $1M.

Of course, Bellevue blew past that figure some 4-plus years ago and is now pricing single-family homes at a median of $1,650,000; that’s up 35% from this time last year. The median price per sq. ft. stands at a record $667.

More stunning, though, is that King County single-family home prices have risen by an astronomical 28% since the start of this year. TWENTY-EIGHT PERCENT!! April single-family median prices across the county hit $995,000 and will very likely break the $1M plateau next month.

Signs of a slowdown are creeping into the outer reaches of the county – listings sitting longer and some dropping prices – but most numbers continue to reflect intense activity with buyers still facing stiff competition for homes. Amid accelerated price appreciation, the market is still bubbling along. (Oops, I won’t use “bubble” again.)

“The high degree at which home sales have faced bidding wars over the past year suggests that sales will initially be resilient in the face of mortgage rate increases due to an excess pool of buyers being available who were previously outbid or couldn’t find an appropriate home,” opines a recent housing update from Freddie Mac. “We expect this group will help maintain sales in the near term but with fewer bidding wars.”

The number of new and active listings (still on the market May 1) is trending higher in King month-to-month, but since June 2021 Pending sales (homes going under contract) for all residential units in the county have declined compared to the same month the year before. That includes 621 fewer Pending contracts in April 2022 than the previous April, as the net number of new listings remains on average lower than in years past.

“The falling contract signings are implying that multiple offers will soon dissipate and be replaced by much calmer and normalized market conditions,” said Lawrence Yun, the chief economist for the National Association of Realtors®. “The aspiration to purchase a home remains, but the financial capacity has become a major limiting factor.”

The increased number of listings and slight slow-down of the market have helped boost inventory numbers. April supply across King for all home types and single-family homes stood at 0.7 months (homes on the market would be exhausted after 21 days if no other listings were added), up from 0.5 a month ago. Total supply on the Eastside (0.7 months) was fractionally worse than in Seattle (0.8), where the Central District (including Capitol Hill) was enjoying a relative wealth of inventory at 1.1 months.

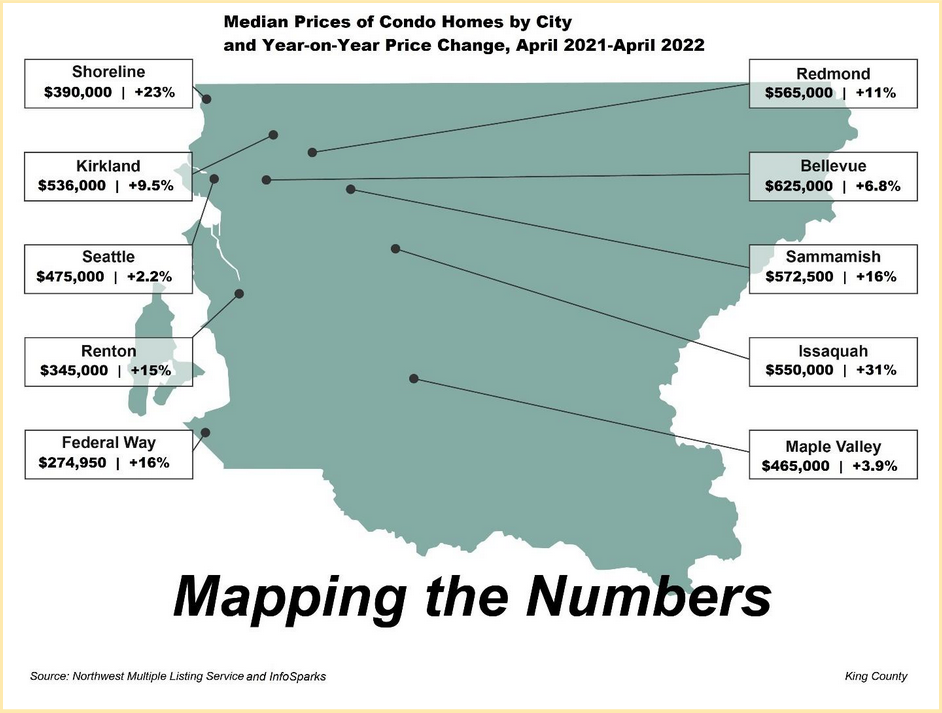

The number of actively listed condo homes jumped 27% in King County from March to April, including a 32% surge in available homes on the Eastside. Median prices for condos ranged from $674,444 on the Eastside (up 7.1% in one month and 30% year-on-year) to $512,500 in Seattle (unchanged from March and up 4.6% YoY). Prices across the county actually fell 4.1% for the month to $518,000, a 13% rise in the past year. Condo inventories rose in the past month across the county (0.8 months), including the Eastside (0.5) and Seattle (1.1).

In addition to King County’s 4.9% median price month-to-month increase on all home types, to $880,000, Snohomish County saw the sharpest jump – a rise of 5.4% from March to April ($800,000). Kitsap added 4.4% on its median price ($558,500) since March while Pierce rose 2.5% ($564,000). Single-family home prices in King jumped 7.0% in a month ($995,000), followed by both Snohomish ($839,298) and Kitsap ($565,000) at 4.9% and Pierce up 4.1% month-to-month ($579,980). Year-to-year, single-family median prices soared in our region, led by a 24% jump in Snohomish, 20% in King, 16% in Pierce and 15% in Kitsap.

Click here for the full monthly report.

CONDO NEWS

JADE Residences, the just-opened 136-unit condo in Kirkland, recently closed its 100th sale – a significant milestone as local developer Terrene navigated through a most challenging time in local real estate (thanks a lot, pandemic!).

JADE is a welcome arrival to the newly revitalized Totem Lake neighborhood. The 6-story structure offers a wide range of amenities including a full-time concierge, fitness center, screening room, rooftop deck with outdoor kitchen, and resident lounge [Jade Club Room] with catering kitchen and private dining area.

The property is also just steps from the Village at Totem Lake. The newly developed urban center includes hundreds of apartment units as well as two major grocery chains, a department store, pizza shop and cinema in a pedestrianized village.

It’s how modern suburban living should be – the blending of residential and commercial areas – for people looking for everything within walking distance. Contact me to learn more or to take a tour of JADE.

—–

Real estate brokers have access to a lot of information about a condominium’s finances through the packet of resale certification documents shared before the home is purchased. In poring through those documents for Insignia Towers in Belltown, it is interesting that 47 of the 698 owners are delinquent at least 60 days on their HOA dues totaling about $92K.

That’s noteworthy to underwriters who review these same documents to determine the risk of lending to a buyer. The above figures apparently have caused some financial institutions this year to reject mortgage applications on Insignia properties, with one insider saying only three lending firms are currently available to provide a mortgage to buyers – no doubt at a higher interest rate to reflect the increased risk.

—–

KODA is at it again! The 17-story condo in the Chinatown-International District is offering to pay homeowners’ dues for up to two years to new buyers. The offer – which is valued at about $8665/year based on an 870 sq. ft. home – ends May 31.

The sales team is aggressively looking to complete sales of its unsold residences (about 100 units to go) with this promotion on any 1-bedroom plus flex-room plan on floors seven and higher. The offer is good for up to one year of free HOA dues to buyers of similar homes on floors 2-6.

LUXURY LIVING

There is luxury and then there is SUPER LUXURY! A property has hit the market with an earth-shattering price tag of $85M – a record-setter for the Pacific Northwest. It’s a 5-bedroom, 7.75-bath, 17,599 sq. ft., mansion (pictured; Source: Google Earth) with three additional buildings on 4.3 acres along an incredible 327 feet of waterfront on Hunts Point. The 2-story residence was built in 1995 and features wide-plank wood flooring, impeccably designed interiors, radiant floors, HEPA air filtration and eight fireplaces. The grounds have a tennis court and outdoor pool. Other buildings include a staff quarters, cabana and beach house. Total interior space is priced at $4830/sq. ft., with annual property taxes at, gulp!, $233,383! World renowned saxophonist Kenny G was the original owner of this East-facing property. The record for a home sale in our area was a 2020 deal at $60M, on the same Hunts Point street as this property.

There is luxury and then there is SUPER LUXURY! A property has hit the market with an earth-shattering price tag of $85M – a record-setter for the Pacific Northwest. It’s a 5-bedroom, 7.75-bath, 17,599 sq. ft., mansion (pictured; Source: Google Earth) with three additional buildings on 4.3 acres along an incredible 327 feet of waterfront on Hunts Point. The 2-story residence was built in 1995 and features wide-plank wood flooring, impeccably designed interiors, radiant floors, HEPA air filtration and eight fireplaces. The grounds have a tennis court and outdoor pool. Other buildings include a staff quarters, cabana and beach house. Total interior space is priced at $4830/sq. ft., with annual property taxes at, gulp!, $233,383! World renowned saxophonist Kenny G was the original owner of this East-facing property. The record for a home sale in our area was a 2020 deal at $60M, on the same Hunts Point street as this property.

A 2-story Spanish revival is on the market for the first time in 37 years. A one-time residence to the late Washington Gov. Albert Rosellini, this extraordinary 1925-built home has 4-bedrooms, 4-baths, 4470 sq. ft. on a just-shy half-acre in the Mt. Baker neighborhood of Seattle. (What may be truly impressive are the sellers, now empty-nesters after raising eight children in this home!) Designed by William J. Bain, who founded what is now Seattle architectural firm NBBJ, the home features period details throughout, including a titled entry, custom archways, leaded-glass windows and turret. Check out the views of Lake Washington. List price: $3.495M ($782/sq. ft.). UPDATE: This home is now under contract, pending inspection.

If you’re looking for contemporary and classic combined, try this 4-bed, 6.5-bath, 6920 sq. ft., 2-story masterpiece in Medina. Wendell Lovett designed this Beaux Arts 1995 stunner, with walls of windows, super-height ceilings and an unbelievable 125-feet of Lake Washington waterfront. And what a thoughtful listing video. It’s modernism in Medina! List: $21.5M ($3107/sq. ft.).

On the same street but at the opposite end of Medina, this 4-bed, 4.75-bath, 6750 sq. ft., 1996-built, 2-story standout is seeking $23.5M ($3604/sq. ft.). That’s about a $4.9M price drop from its original list price five weeks ago. The home features similar windows and tall ceilings as the above listing, as well as a large luxury office with solid walnut cabinets, a reading nook designed as an Egyptian pyramid, cove lighting and one-thousand-bottle wine cellar with hand-painted ceiling (hat tip to Puget Sound Business Journal for the rich details).

A home in one of the most exclusive Seattle communities is on the market in Madison Park. It is a 3-bed, 4.25-bath, 8360 sq. ft., 1-story residence, one of only nine properties on what is known as the Reed Estate. The home comes with 135 feet of Lake Washington waterfront, outdoor pool with spa tub and rose garden. The property is reportedly owned by a member of the Pigott family, founders of truck manufacturer Paccar. List: $35M ($4187/sq. ft.).

Many homes like to include the good-luck number “8” in their price. Take this Bellevue beauty with a price tag of $8.88M ($620/sq. ft.). Currently under construction, it’s listed on the MLS as a 5-bed, 6-bath home with 14,314 sq. ft. of interior space on 1.3 acres in the Newport Shores neighborhood. The contractor is willing to make changes to the home as it is being built – at the new owner’s expense. Oh, did I mention the pool, guest house and 18-vehicle garage!?

I had to share this new listing because of the fantastic listing video. It will help sell this 3-bed, 5-bath, 4690 sq. ft., 2-story modern Zen home with heated outdoor pool in Redmond. There is so much to love about this 2010 custom home. List: $7.2M ($1535/sq. ft.).

Updating you on the home-selling and -buying activities of Russell Wilson and his wife Ciara, the family has reportedly purchased new digs in Denver. The Wilson’s Bellevue mansion along Lake Washington remains on the market at $28M ($2522/sq. ft.). Buyers may offer to purchase an adjacent lot together with the home for $36M.